A UNIQUE AND COMPLEX MACRO ENVIRONMENT TODAY

COVID has been a “black swan” event that severely disrupted a normal market cycle and our daily lives starting in 2020. With breakthrough vaccines and unprecedented stimulus support, the global economy staged a strong synchronized demand recovery, which has also now resulted in historically high inflation in many countries. To curb inflation, central banks have commenced tightening financial market conditions by raising interest rates and through quantitative tightening (QT). As a result, the risk of a recession over the next 12 months has escalated.1

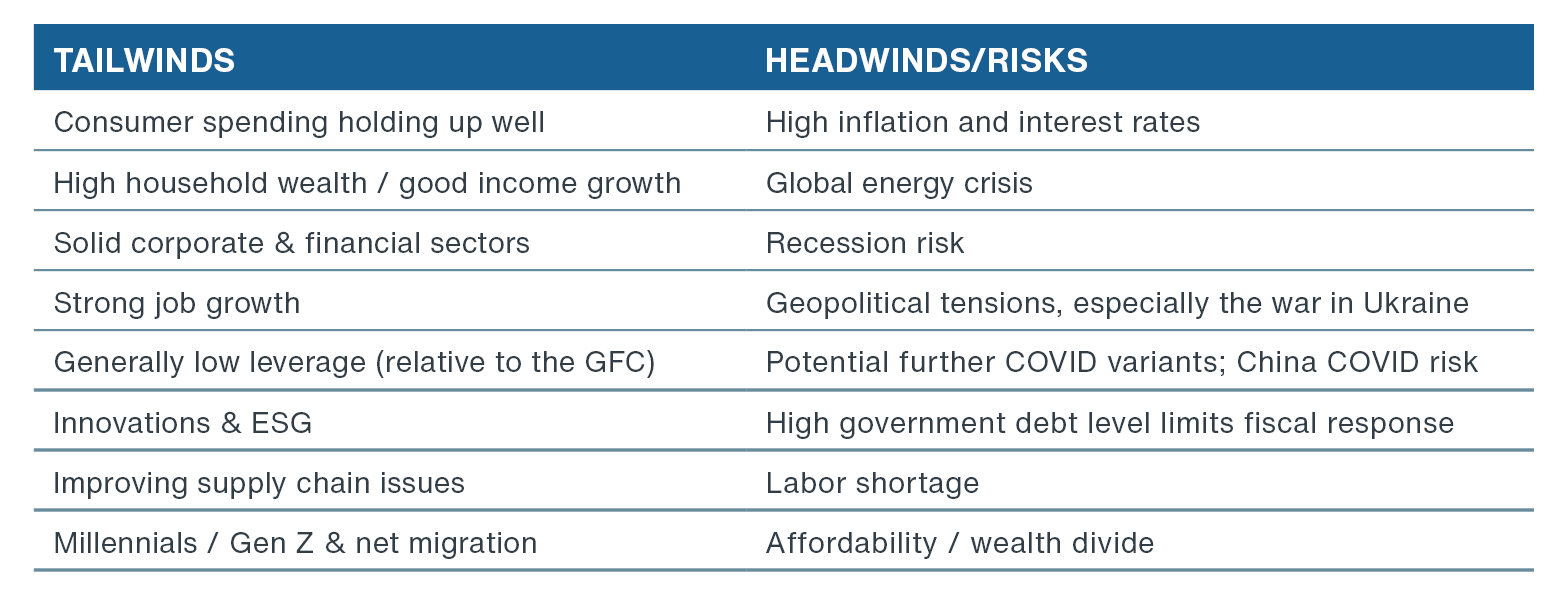

Notwithstanding these economic headwinds, there are still significant positive tailwinds that, when taken together, make the U.S. macro backdrop particularly uncertain at this time

(Figure 1). National consumer spending, labor markets, business activity, corporate balance sheets, and the banking system have all continued to be relatively healthy, with much lower leverage than before the Global Financial Crisis (GFC). In June 2022, all 33 of the largest financial institutions passed the annual stress test conducted by the Federal Reserve, suggesting a sound financial industry.

Despite near-term uncertainties, Clarion Partners is optimistic about the long-term outlook for the U.S economy and commercial real estate (CRE) performance. The Millennials and Gen Z, the largest generations in history, are entering their peak earning and spending years, which should drive demand growth and property appreciation over the next 10-15 years.

FIGURE 1: MACRO INVESTMENT DYNAMICS Source: Clarion Partners Investment Research, October 2022.

Source: Clarion Partners Investment Research, October 2022.

A RECESSION OR A SOFT LANDING?

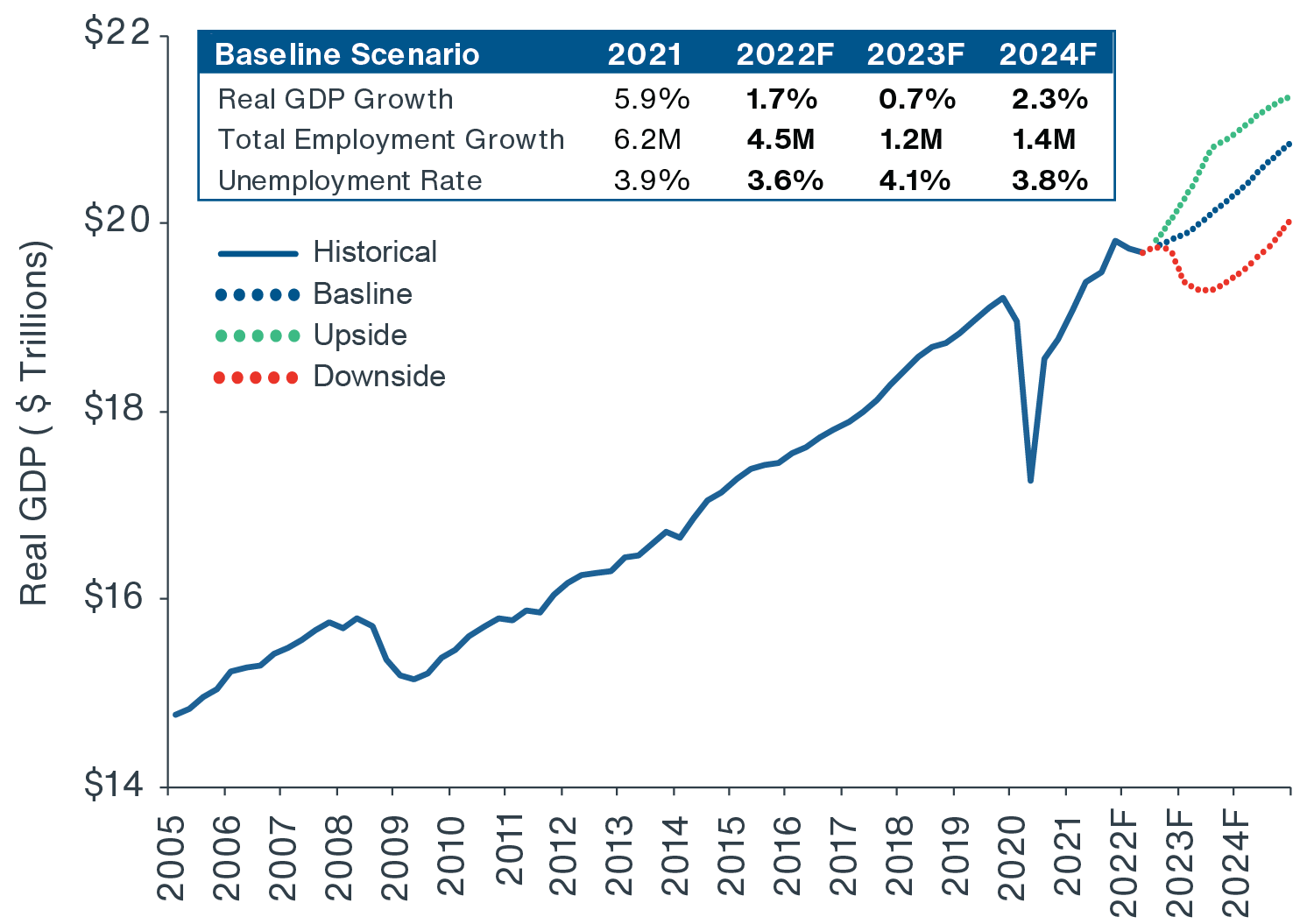

Depending on how quickly inflation will respond to the Fed’s tightening, several possible economic scenarios could play out over the next 1-2 years. Nonetheless, we do not believe that the coming slowdown will repeat the severity of the GFC. Moody’s Analytics’ baseline forecast for U.S. economic growth is generally positive, with an expected creation of 6.1 million new jobs from 2022 to 2024

(Figure 2). The current unemployment rate of 3.5% is near its all-time low, and there are more job openings (10.1 million) than the total unemployed (6.0 million). Under this baseline scenario, significant job loss is not expected over the next two years, which should bode well for real estate fundamentals. However, if the U.S. economy falls into a recession, we might see large job loss, hurting consumer spending and lowering real estate rent growth.

FIGURE 2: MOODY'S REAL GDP & TOTAL EMPLOYMENT GROWTH FORECASTS

Source: Moody's Analytics, Clarion Partners Investment Research, October 2022. Note: Real GDP in 2012 dollars. Forecasts as of October 2022.2

REAL ESTATE PERFORMED WELL DURING PERIODS OF RISING INTEREST RATES

Since March 2022, the Fed has aggressively raised the target Fed funds rate to 3.0-3.25% and started QT by beginning to unwind its $9 trillion balance sheet (now targeting $90 billion per month), which will continue to reduce liquidity across the financial system.

The latest Federal Open Market Committee (FOMC) guidance indicates that the Fed funds rate is expected to reverse after reaching 4.5% in early 2023 and may moderate thereafter assuming that inflation shows clear signs of progress towards the Committee’s 2% target.3 At the same time, the 10-year Treasury yield has also climbed to over 3.5% in recent months (currently fluctuating between 3.5% and 4.0%), raising questions of how CRE will perform during this uncertain time.

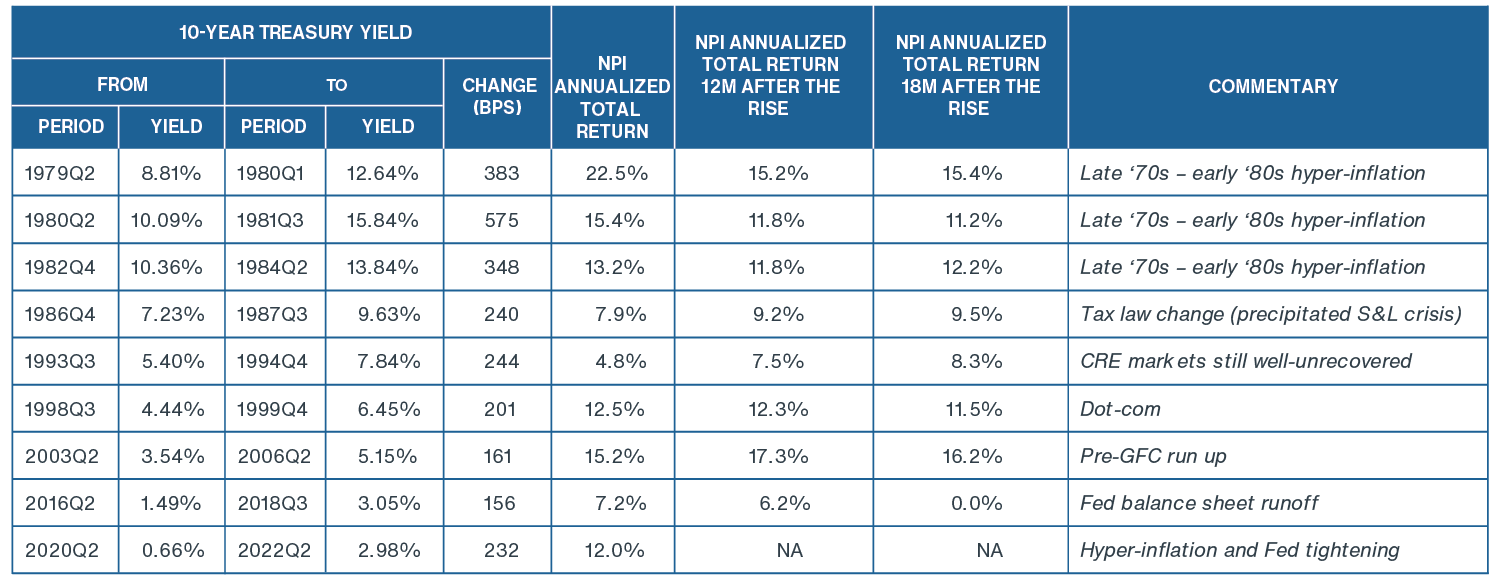

Historically, U.S. CRE investment performance has reacted favorably in periods of rising interest rates. Rising interest rates are usually related to a strengthening of the U.S. economy, which often leads to higher demand for commercial space. An analysis of NCREIF Property Index (NPI) total returns shows that private core real estate investment performance was usually strong during periods of rising 10-year Treasury yield, as well as during the 12-18 months thereafter

(Figure 3). In recent periods, strong demand has indeed been seen in most property types. Rent growth and higher replacement costs are likely to sustain net operating income (NOI) growth in the near future, which may offset – at least partially – the negative impacts from higher interest rates.

FIGURE 3: NPI TOTAL RETURNS DURING PERIODS OF RISING 10-YEAR TREASURY YIELD

Source: Bloomberg, NCREIF, Clarion Partners Investment Research, Q2 2022. Note: Q3 2022 NPI total return data are not available yet.

Source: Bloomberg, NCREIF, Clarion Partners Investment Research, Q2 2022. Note: Q3 2022 NPI total return data are not available yet.

PRIVATE REAL ESTATE HAS HAD STRONG RECENT PERFORMANCE

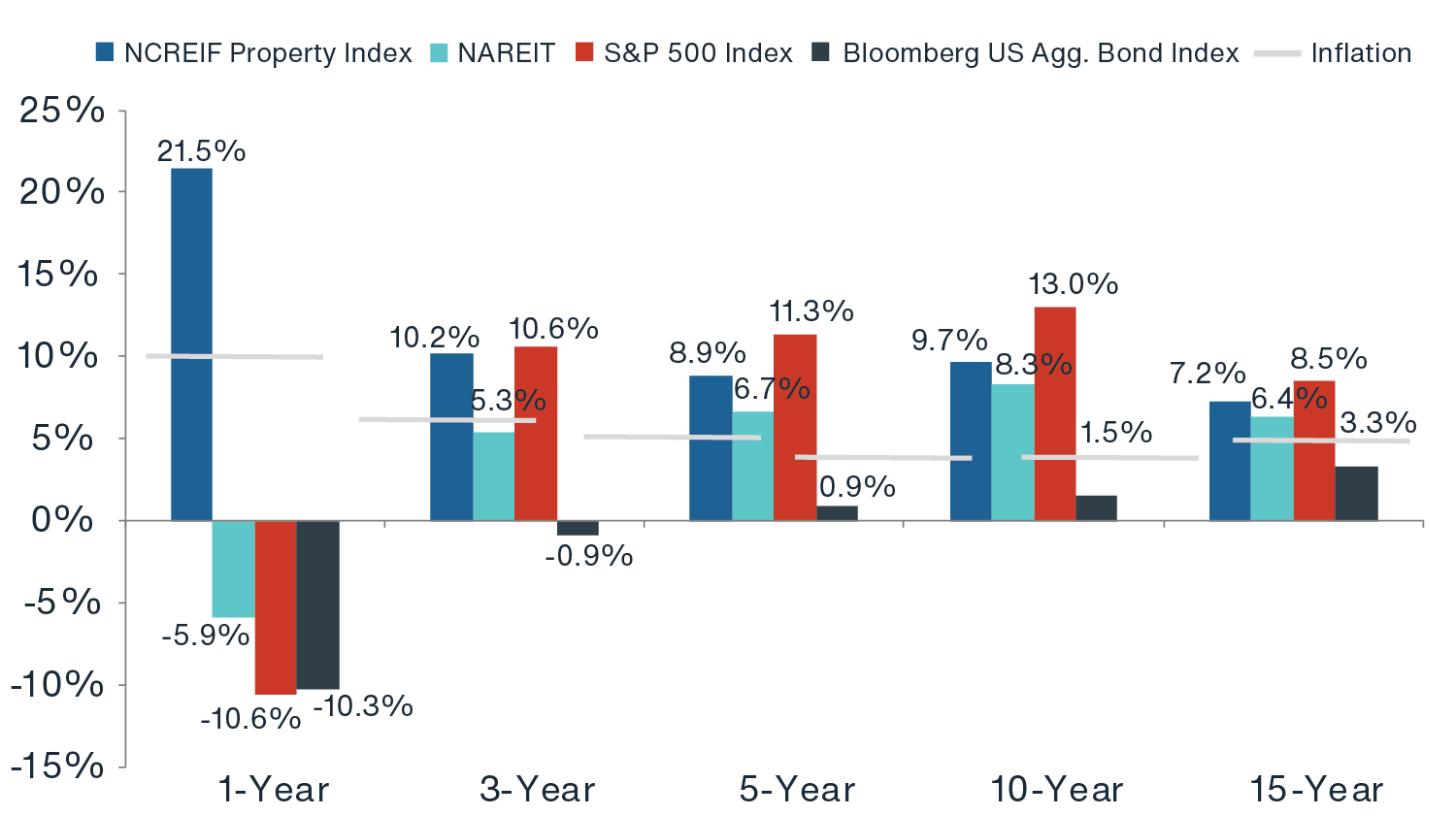

The U.S. economic growth outlook has continued to moderate over the course of 2022. Despite significant financial market volatility, private core real estate investment returns have remained largely resilient. Robust job and wage growth, along with historically low vacancy, have been key factors sustaining healthy property-level fundamentals. Over the past year, the NPI total return performance has been strong, outperforming the FTSE NAREIT All Equity Index, the S&P 500 Index, and the Bloomberg U.S. Aggregate Bond Index

(Figure 4). Furthermore, over the past 15 years, private core real estate has proven to be a good hedge against inflation and provided diversification benefits within a mixed-asset portfolio due to very low or negative correlations with stocks and bonds.

FIGURE 4: STOCK, BOND, & REAL ESTATE TOTAL RETURN PERFORMANCE (Q2 2022)

Source: NCREIF, NAREIT, Bloomberg, Moody’s Analytics, Clarion Partners Investment Research, October 2022. Note: Inflation is the CPI Index; Return data is through Q2 2022; Q3 NPI total return data is not available yet.

OVERALL HEALTHY PROPERTY FUNDAMENTALS

Because of strong job growth and overall demand for commercial space, property cash flows have continued to be relatively healthy. While some property sectors, such as office and malls, have not fully recovered from the pandemic impacts, other property sectors, like industrial, apartment, life sciences, and self-storage, have reported sizable ongoing rent growth

(Figure 5). In addition, there is a manageable level of new supply, especially since elevated construction costs, supply chain disruptions, and high labor costs present additional headwinds for new development projects.

Geographically, high-growth markets with thriving industries, business-friendly policies, and strong demographics have also seen robust investment performance given the strength of underlying demand fundamentals. Steady migration and corporate relocations have led to outperformance in many Sun Belt metros and select premier suburban areas.

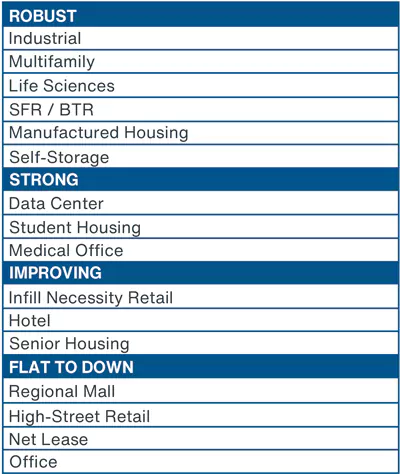

FIGURE 5: U.S. REAL ESTATE FUNDAMENTALS & PRICING POWER BY PROPERTY SECTOR

Source: Clarion Partners Investment Research, October 2022. Note: SFR = single-family rental, BTR = build-to-rent.

IMPACT FROM SHIFTING CAPITAL MARKETS

The combination of higher inflation and rising interest rates will, nonetheless, likely continue to have a material yet varied impact on the U.S. CRE market. While property fundamentals have largely remained stable over the past several months, there have been some disruptions across real estate debt and equity capital markets. Ten-year financing costs have risen by approximately 200 bps year-to-date (through September), and higher financing costs, along with tighter lending standards, have added some upward pressure on cap rates and downward pressure on property values.

With these shifts and continued economic ambiguity, the CRE markets are in a period of price (re)discovery. Underwriting is more challenging given elevated market volatilities, the momentum in U.S. transaction volume has cooled, and there has been a significant thinning of buyer and lender pools. Clarion Partners does expect cap rates to expand; however, the magnitude will depend on various factors. The risk profile of individual assets (sector type, market, and lease terms) will matter significantly. High-quality assets with strong NOI growth should fare relatively better. The future course of cap rate expansion will also be influenced by the ultimate course of long-term Treasury rates, which may or may not already reflect the Fed’s announced policy path.

There is a near record amount of “dry powder” on the sidelines to be invested in CRE, but much of which is cautious at the moment given the current economic climate. At the same time, most owners are not over-leveraged and are under little distress to sell right away. For these reasons, it is likely that the transaction market re-pricing will not be as severe as during the GFC, and investment sales may be more muted in the near-term. Property value adjustments will be determined by the pace of property NOI growth (a positive) and cap rate expansion (a negative). Therefore, it is important for investors to focus on the property sectors, target markets, and assets that have strong fundamentals and can benefit from inflation, with the pricing power to raise rents over the long run.

INVESTMENT OUTLOOK

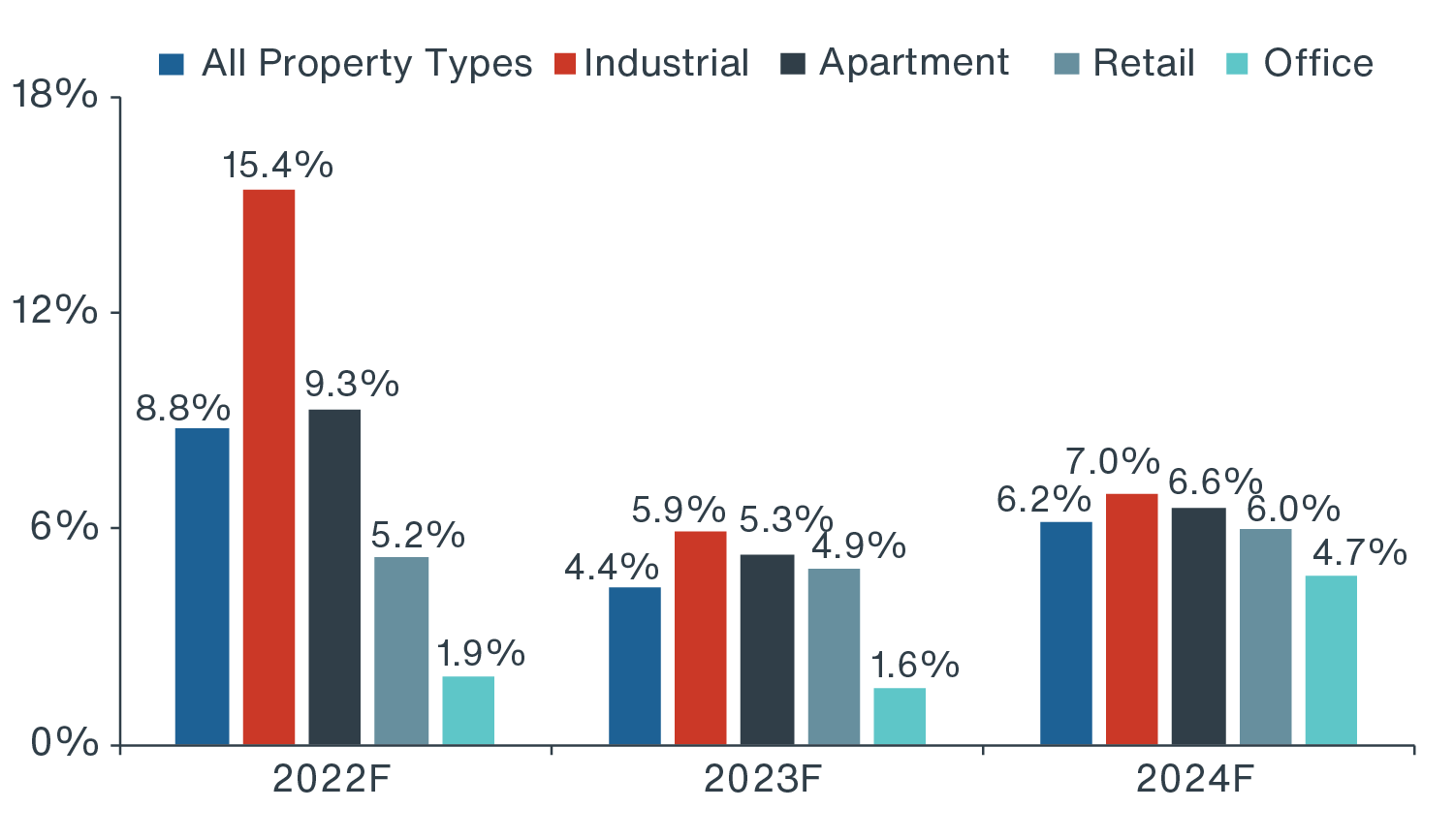

From a market expectation viewpoint, the Q3 2022 PREA Consensus Forecast indicates the belief in a significant moderation to the near-term outlook for NPI total returns, clearly reflecting the broader slowdown in the U.S. economy and higher rate environment. The PREA forecast projects an 8.8% and 4.4% total return for the NPI Index in 2022 and 2023, respectively

(Figure 6), which suggests relatively modest property value declines in late 2022 and early 2023.

Of course, returns will likely vary greatly by sector, region, and asset quality. The PREA forecast also suggests a meaningful rebound in 2024 and the continued dispersion in performance, led by industrial and apartment, followed by retail and office.

FIGURE 6: PREA CONSENSUS FORECAST OF THE NPI INDEX UNLEVERED TOTAL RETURN

Source: PREA, Clarion Partners Investment Research, September 2022. Note: This consensus forecast was conducted by PREA as of Q3 2022 and is the average of 24 institutional investors’ and managers’ forecasts.

Source: PREA, Clarion Partners Investment Research, September 2022. Note: This consensus forecast was conducted by PREA as of Q3 2022 and is the average of 24 institutional investors’ and managers’ forecasts.

From the transaction market viewpoint, the shifts in the CRE debt markets have created notable market dislocations, which may present attractive acquisitions opportunities.

− Institutional CRE investors may be able to acquire high-quality assets at a discount (and at scale) amidst inefficiencies across markets.

− Higher cap rates suggest future income returns not seen in real estate in quite some time, perhaps supplementing future value growth.

− Real estate credit and mezzanine financing are particularly appealing as rates increase and senior lenders become more conservative with lower LTV ratios and higher DSCR coverage.

− Also, if public REIT stocks decline significantly and become traded well below their net asset values (NAV), privatization is another potential strategy to capitalize on pricing differences.

SUMMARY

Clarion Partners believes that investors should take a long-term view during this period of uncertainty and remain patient. Current macro risks and market dislocations may also create attractive buying opportunities over the next 12 to 18 months. In the long run, we recommend that investors maintain an adequate allocation to CRE, which has proven to be an effective inflation hedge historically and to offer portfolio diversification benefits. As CRE transitions into the next market cycle, we also recommend positioning portfolios for better risk-adjusted performance with an overweight to property sectors and markets that have strong pricing power and can grow cash flow over time.