A DRAMATIC ACCELERATION OF E-COMMERCE GLOBALLY

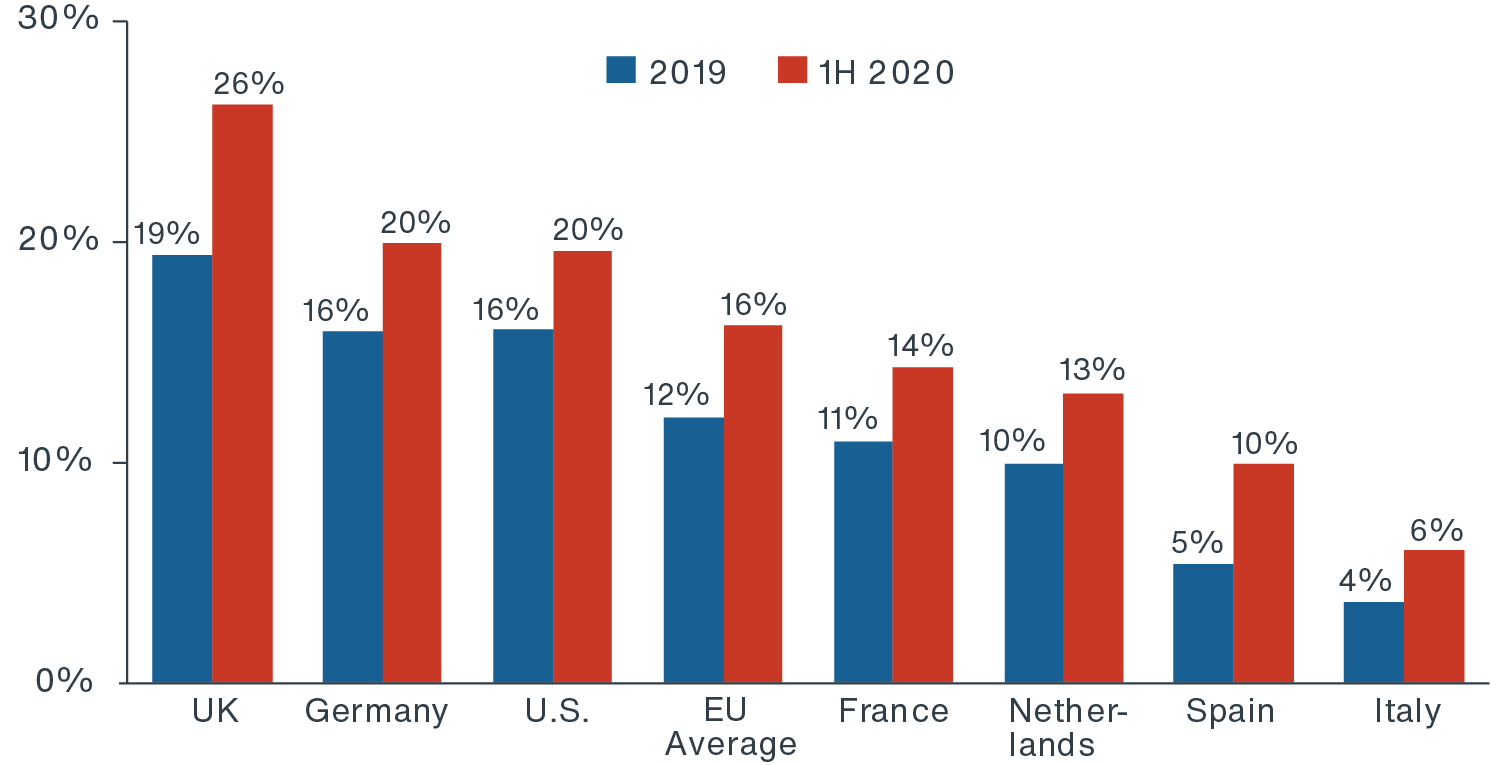

Omnichannel retail continues to drive rapid transformation in worldwide supply chains and logistics real estate. Recently, the global COVID-19 pandemic has dramatically accelerated e-commerce penetration rates and sales growth. Throughout Europe and the United States, e-commerce as a percentage of total core retail sales was approximately 15% in 2019.1 This share rose precipitously following the onset of COVID-19 in many countries worldwide. Globally, the e-commerce market share could rise to almost 25% by 2023 (or even 45% by 2030), as online sales have continued to grow at a double-digit rate.2 Thus, demand for industrial warehouse and distribution property is expected to remain strong in the years ahead.3

Clarion Partners believes that the future expansion of global logistics real estate will be especially robust in Europe, given that institutional-quality property markets there are less developed overall.4 Despite that, the region has both a higher total population and population density.

E-COMMERCE SALES AS % OF CORE RETAIL SALES IN SELECTED COUNTRY

Source: Center for Retail Research. July 2020, Clarion Partners Investment Research, Q2 2020. Note: European shares are calculated as of July 2020 and the U.S. is as of June 2020.5

Furthermore, a few universal global trends will continue to drive the EU warehouse market’s expansion:

- Rising global consumption and trade;

- Last-mile infrastructure for fast delivery serving the urban logistics boom;

- A growing dominance of large retailers (e.g. Amazon, Walmart, and Apple);

- The recent e-grocery boom

EARLY INNINGS FOR EUROPEAN INDUSTRIAL

Today, the U.S. is the largest commercial real estate (CRE) market in the world, and industrial property accounts for approximately 20% of overall CRE investment.6 In Europe, as well as in the U.S., it has been estimated that USD $1 billion in new e-commerce sales ≈ 1.25 million sf of new warehouse demand, and e-commerce and 3PL tenants have accounted for a large share of total industrial net absorption in recent years.7

Europe is the fastest-growing professionally-managed property market (excluding China). More and more capital is being committed to industrial assets in the region, where it is still relatively early in the build-out of e-commerce infrastructure. Online sales as a share of total core retail sales vary greatly by country with a few laggards (e.g. Spain, Italy, Austria, Switzerland, Norway, Belgium, France) now ranging between 6% and 11%.8

Currently, European logistics lags the U.S. in total stock and penetration (sf per capita). Recent reports indicate low Class A vacancy and a general undersupply of modern warehouse inventory in many European countries overall. In Q2 2020, (pre-COVID-19), the average European market vacancy rate was 4.0%.9 Clarion Partners believes future growth prospects are now especially compelling throughout Europe given the post-pandemic e-commerce surge and less-mature warehouse and distribution property markets.

STRONG MOMENTUM IN EU CAPITAL MARKETS

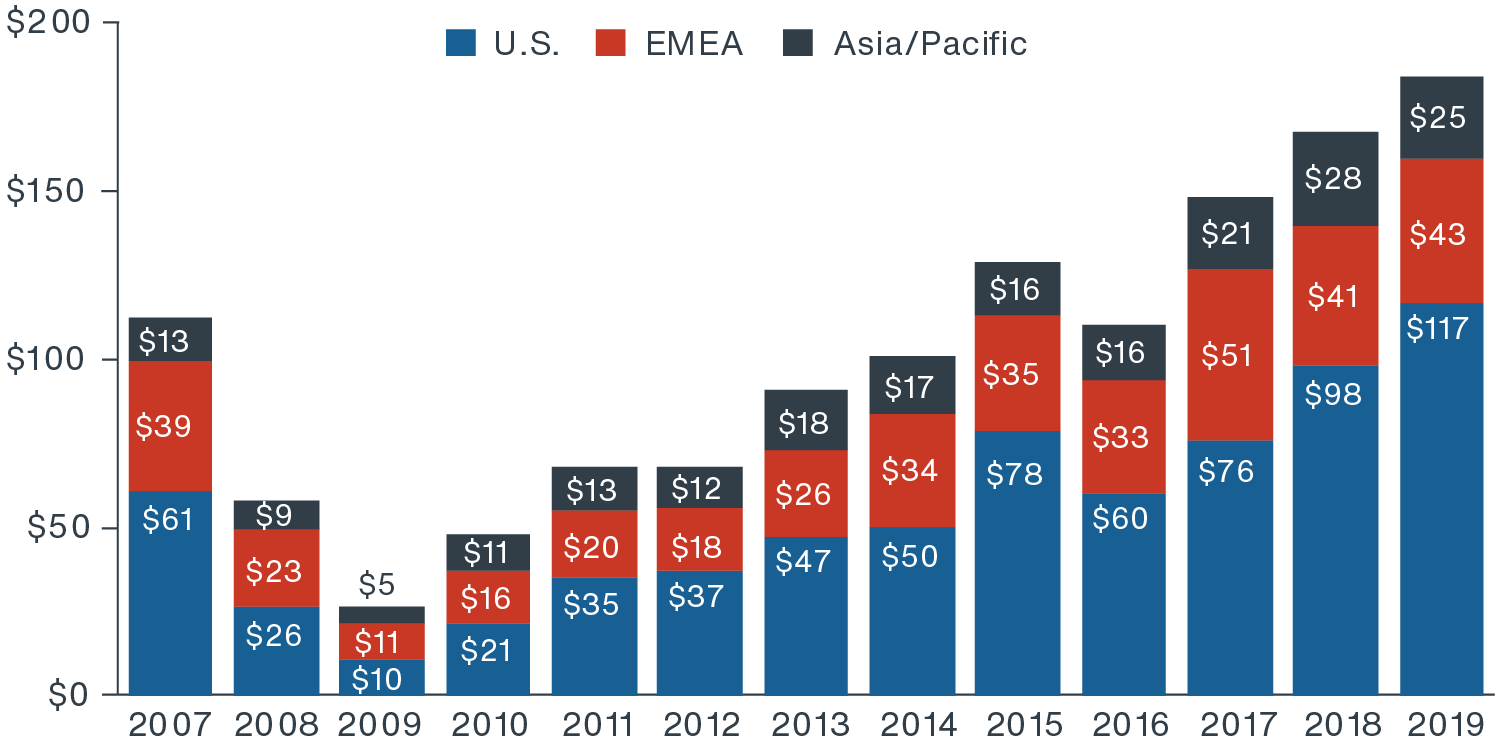

In 2019, global industrial transaction volume climbed to a record high of USD $170 billion - with USD $116 billion in the U.S. and US in the Europe Middle East and Africa (EMEA) region. Industrial property represented about 10% of all $1.7 trillion transaction volume worldwide. To date, the U.S. has attracted a much larger share of logistics capital investment; however, the EMEA region has gained traction in recent years.

Recently, investment sales in Europe reached the strongest levels on record. Overall, CRE transaction volumes reached USD $84.8 billion in Europe in Q1 2020, up 51% year-over-year, surpassing the previous high registered in Q1 2015. Still, post-COVID-19, EU industrial investment sales were up 10% based on the trailing twelve-month (TTM) total as of Q2.10 We expect a full and rapid recovery in sales volume as the public health crisis stabilizes.

GLOBAL INDUSTRIAL TRANSACTION VOLUME REACHES A RECORD HIGH IN 2019 (USD $)

Source: Real Capital Analytics, Clarion Partners Investment Research, September 2020.

EUROPEAN INDUSTRIAL MARKETS WELL-POSITIONED TO BENEFIT FROM MORE ONLINE SALES & GLOBAL TRADE

Global consumer spending, the primary engine of economic growth and industrial property demand, has remained relatively healthy over the past six months.11 Most believe the downside impact of COVID-19 will be largely shortterm.12 In recent years, global and European trade volumes (measured in twenty-foot equivalent units – “TEUs”) have steadily risen. Europe holds a tremendous amount of wealth and enduring buying power, which will continue to benefit future warehouse demand. European industrial real estate property fundamentals have been very strong, with record low inventory and average rents at all-time highs.13

Clarion Partners believes Europe, in particular, is well-positioned to benefit from expanding global trade for the following reasons:

- Its relative proximity to emerging markets in the Middle East, Africa, Russia, and Asia and the Suez Canal, reaching Southeast Asia;

- High-growth economies within its borders (in both Western and Eastern Europe);

- Amazon’s relatively early entry into most European markets

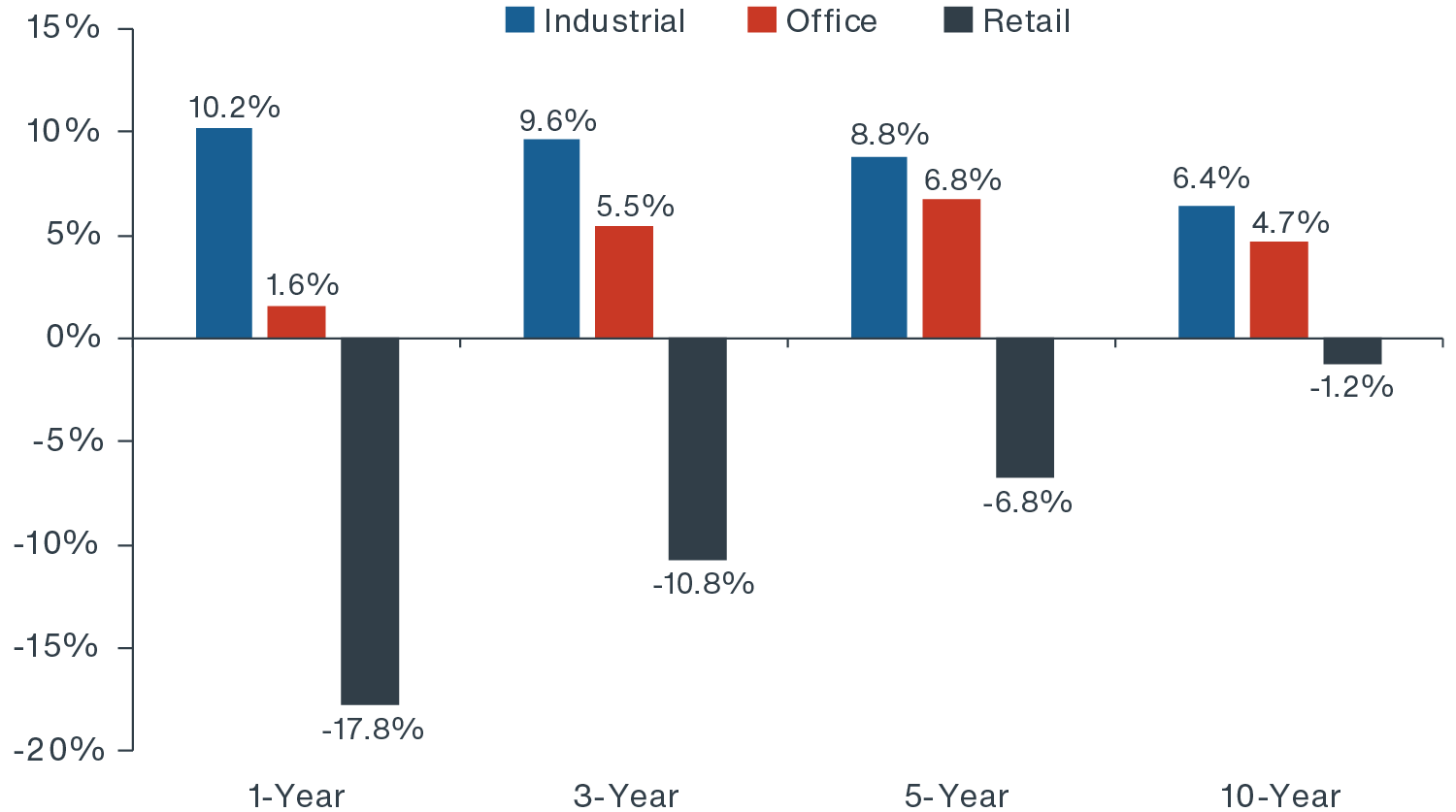

According to Green Street Advisors, the outperformance of European industrial total returns relative to those of the other major sectors over the past several years is significant and bodes well for the industrial sector’s future investment outlook, as does the ongoing rise in institutional investors’ allocations to industrial assets.

EUROPEAN REIT ANNUALIZED TOTAL RETURNS BY SECTOR

Source: Green Street Advisors, Clarion Partners Investment Research, October 2020.Note: Total returns are unlevered and calculated based on Green Street Advisors Europe CPPI Index as of September 2, 2020.