HEALTHCARE

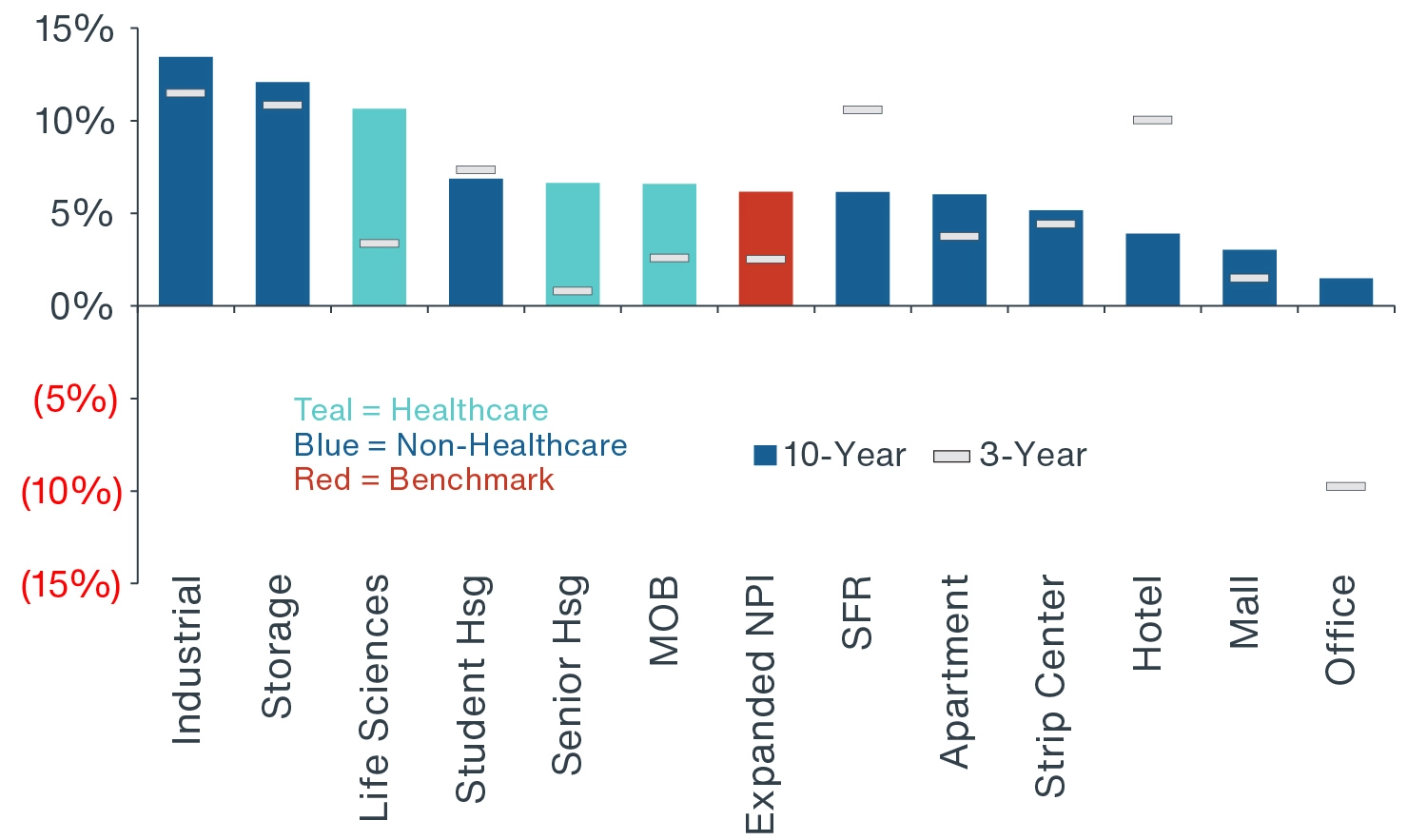

A segment within the Alternative properties sector, healthcare real estate (life sciences, medical facilities, and seniors housing real estate) is benefitting greatly from the growing demand for healthcare research and services fueled by the aging of the massive Baby Boomer age cohort. By 2040, roughly 1 in 5 U.S. residents is expected to be over the age of 651, and U.S. healthcare expenditures are expected to reach $7.7 trillion by 2032 – a 73% increase from 2022.2 This anticipated rise in spending on drugs and therapies should promote continued investments in life sciences research. Government outlays for National Institutes of Health (NIH) research are expected to reach $55.4 billion by 2034 – a 22% increase over the coming decade.3 Over the last ten years, life sciences, seniors housing, and medical facility total returns have all outperformed the NCREIF Property Index (Expanded NPI) on the backs of favorable structural tailwinds in the form of demographic shifts and innovations in medicine and care (Figure 1). While healthcare property performance is no doubt tied to the broader economy and real estate cycle, utilization of healthcare real estate is largely need-based and tied to the growing demands of an aging population, effectively buoying absorption during down periods of the economic cycle and reducing volatility. Given these strong structural demand trends, healthcare property types should remain well positioned to drive attractive risk-adjusted performance in the years ahead. In the following sections, we will briefly explore the key structural trends behind healthcare and the evolution of key property types that stand to benefit.

FIGURE 1: EXPANDED NPI ANNUALIZED TOTAL RETURNS BY SECTOR

Source: NCREIF, Clarion Partners Investment Research, Q2 2024. Note: Expanded NPI includes all NPI properties and all qualified alternative assets. Past performance is not indicative of future results. Please see the important disclosures at the end of this presentation.

DEMOGRAPHICS & INNOVATION ARE TWIN STRUCTURAL DRIVERS OF HEALTHCARE REAL ESTATE DEMAND

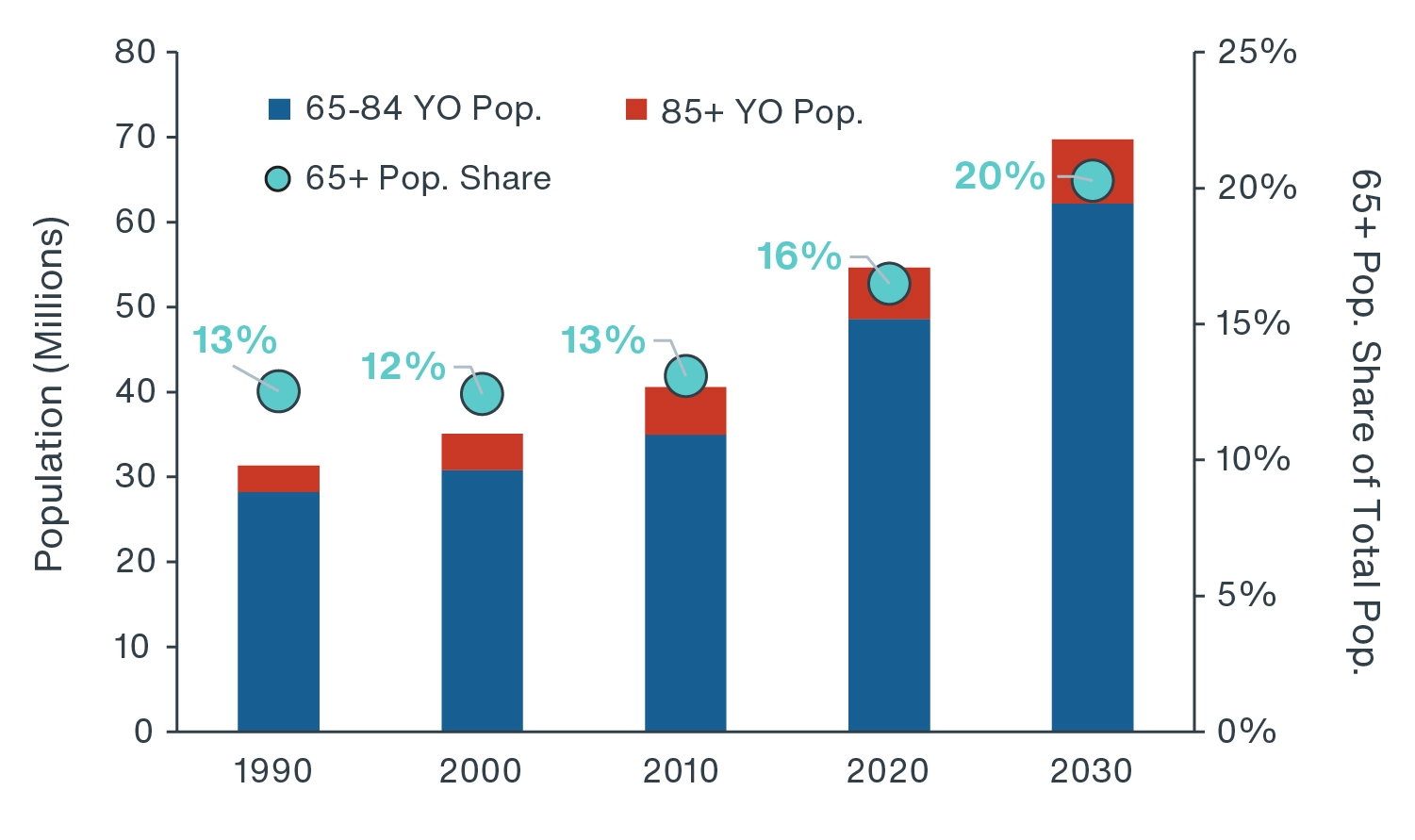

Demographic trends underscore the rising demand for healthcare-driven assets. Overall, due in large part to the country’s declining birth rate and increased life expectancy, the U.S. population is aging rapidly. The 65+ population in the U.S. is expected to grow at an average rate of 2.3% per year through 2030, six times the rate of the overall U.S. population (Figure 2).4 The Baby Boomer cohort (people born between 1946 and 1964), which now accounts for 68 million residents, or 20% of the U.S. population, will undoubtedly drive a substantial rise in healthcare spending and innovation and greatly impact the healthcare system in the years to come. Older age cohorts tend to spend significantly more on healthcare goods and services than younger cohorts, with the 65+ population spending an average of $22,000 per person on healthcare in 2020 (vs. just $9,000 for the 19-64-year-old population).5 Given the aging population and the older cohorts elevated per capita spending, U.S. healthcare expenditures are forecast to increase by 5.6% annually through 2032, with healthcare as share of GDP rising to nearly 20% by 2032, from just 17.3% in 2022.6

FIGURE 2: OLDER AGE COHORT POPULARION GROWTH

Source: U.S. Census Bureau, Moody’s Analytics, Clarion Partners Investment Research, August 2024. Note: Past performance is not indicative of future results. Please see the important disclosures at the end of this presentation.

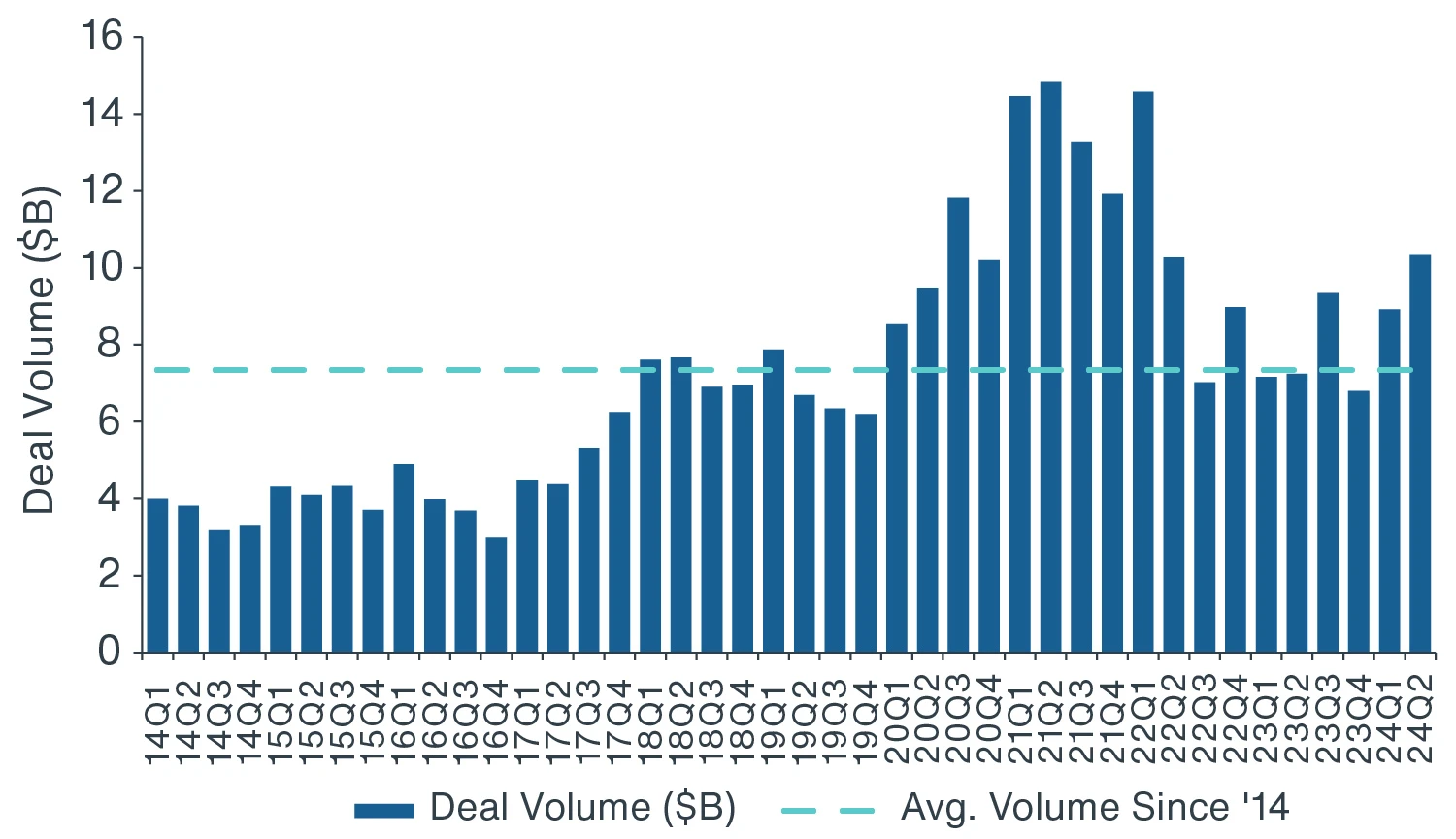

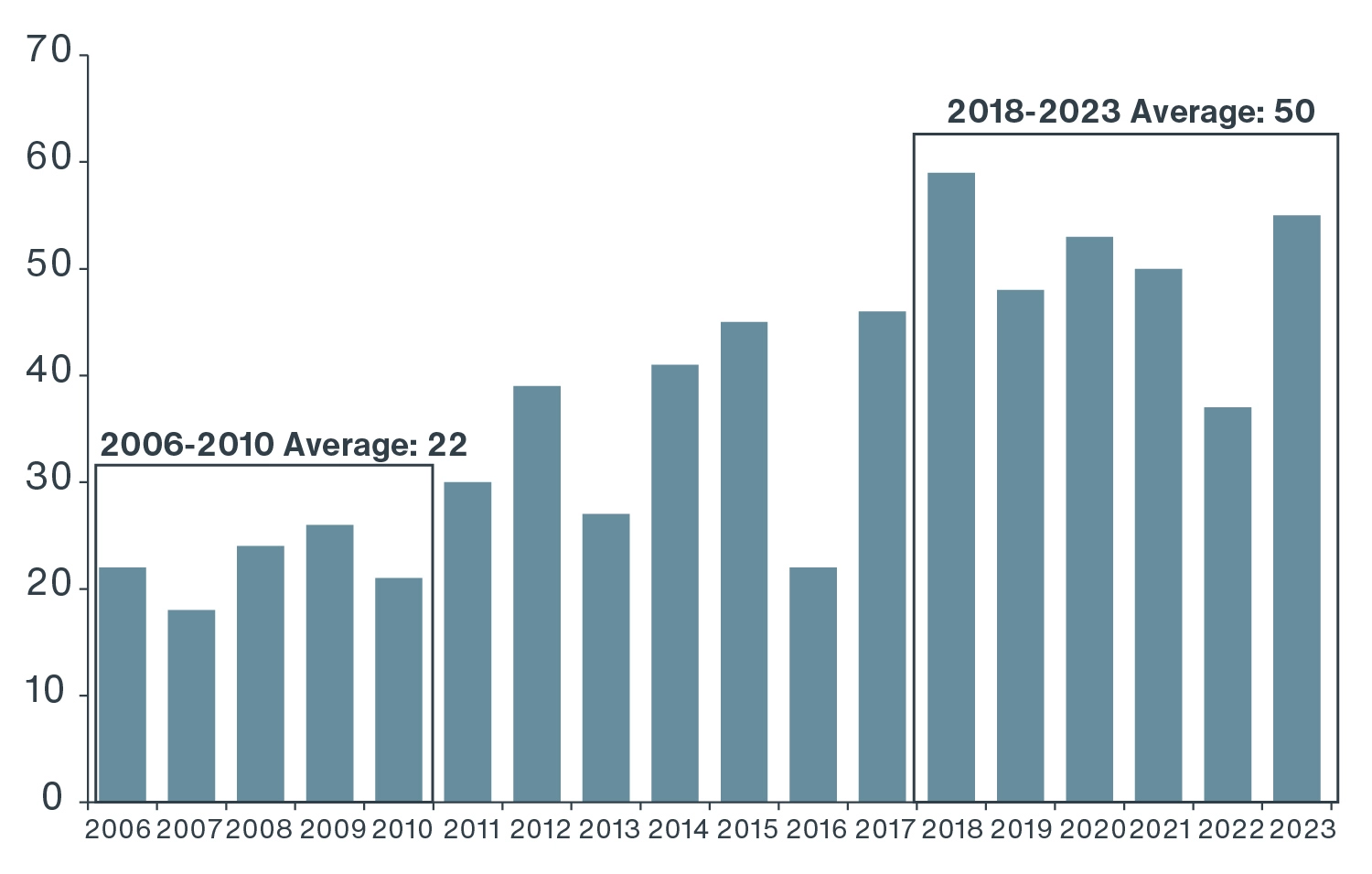

Innovation is another key tailwind for healthcare-driven assets. Elevated public and private funding and the continued growth in R&D spending should drive the formation of new healthcare technology companies, which, in turn, should fuel demand for life sciences real estate. The anticipated growth in healthcare spending should promote investments in life sciences R&D, as the country’s aging population intensifies demand for innovative drugs and therapies. Although venture capital investment in life sciences companies has retreated from a historic high of over $54 billion in 2021, annual venture capital investment into the sector has more than doubled since 2014 (Figure 3). Additionally, advancements in healthcare technology should contribute to a continued rise in average life expectancy, promoting demand across all healthcare property types.

FIGURE 3: LIFE SCIENCES VENTURE CAPITAL DEAL VOLUME ($B)

Source: Pitchbook, Clarion Partners Investment Research, 2024 Q2.

PROPERTY TYPES AT THE INTERSECTION OF DEMOGRAPHICS & INNOVATION

The intersection of an aging and wealthy demographic with the increasing prevalence of innovation-led industries is spurring a fertile market for healthcare-related demand. This, in turn, is fueling demand for property types that directly facilitate healthcare innovation and serve the needs of an aging population: life sciences buildings, medical facilities and seniors housing.

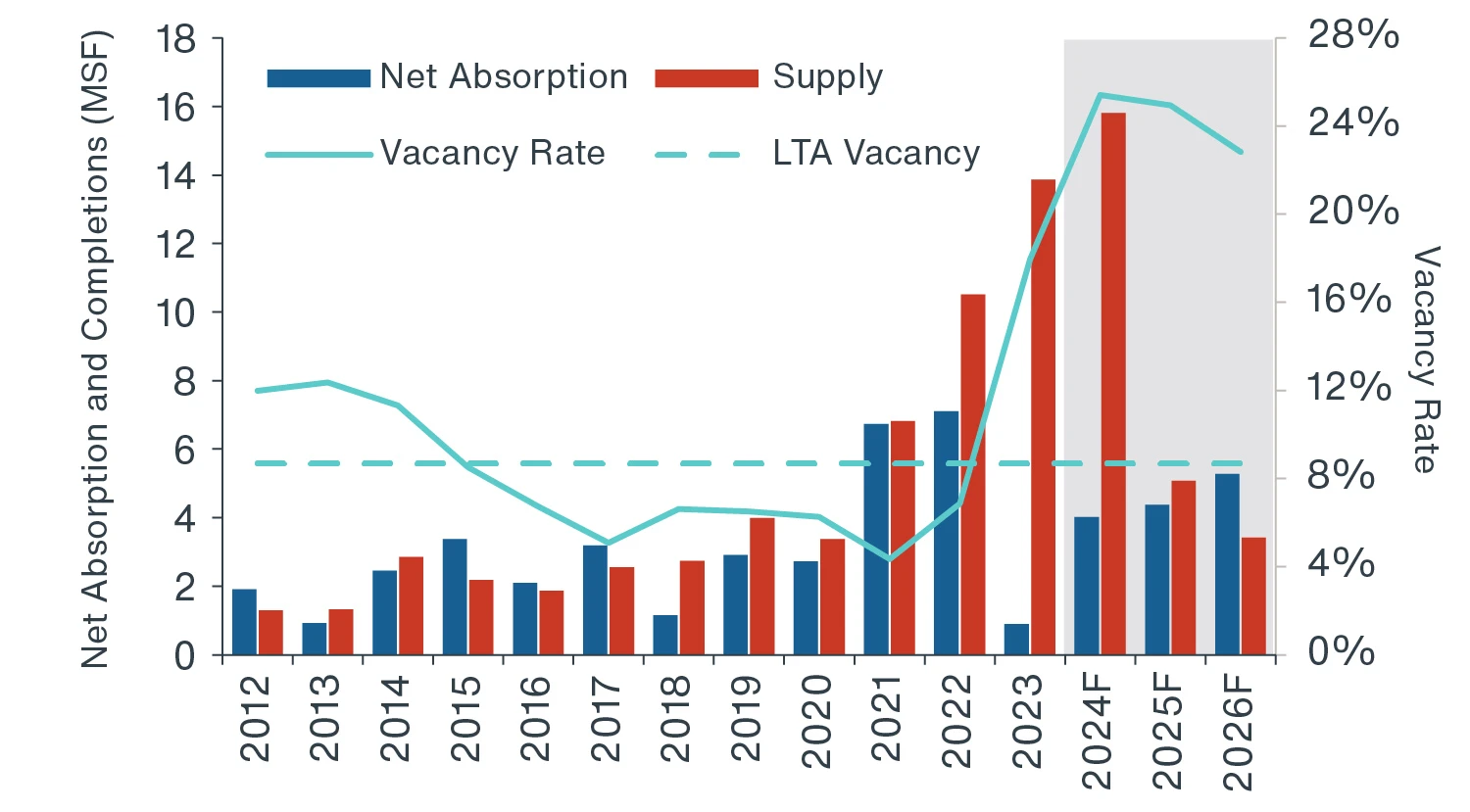

LIFE SCIENCES & LAB OFFICE

Propelled by public and private investment in life sciences R&D and a wealth of innovation spurred by novel drug discovery and the successful commercialization of new technologies, demand for life sciences real estate has increased dramatically over the past decade – a trend accelerated by the COVID-19 pandemic. Life sciences real estate market conditions have softened over the last couple of years, as a sizable supply wave, combined with a notable decline in tenant demand, pushed lab office vacancy rates to historic highs (Figure 4). Despite the broader sector’s lackluster showing as of late, there has been a notable divergence in performance, with properties located in established life sciences clusters and/or owned and operated by experienced sponsors having outperformed. This delta in relative performance is expected to continue in the near future.

FIGURE 4: LIFE SCIENCES NET ABSORPTION, NEW SUPPLY, AND VACANCY (BIG THREE MARKETS: BOSTON, BAY AREA, SAN DIEGO)

Source: JLL, Clarion Partners Investment Research; As of July 2024. Note: Net absorption and completion trends are aggregates of Boston, SF Bay Area, and San Diego life science markets as a proxy for the national series. Forecasts have certain inherent limitations and are based on complex calculations and formulas that contain substantial subjectivity and should not be relied upon as being indicative of future performance. Past performance is not indicative of future results. Please see the important disclosures at the end of this presentation.

Despite the challenging financing environment and declining revenues, biotech innovation has continued, as demonstrated by the growth in the number of active clinical trials and treatments awaiting FDA approval (Figure 5). Small-to-medium life science firms are the primary drivers of drug discovery, as large biopharma companies increasingly depend on acquisitions for drug development and to bolster their therapeutic pipelines.7

FIGURE 5: FDA NOVEL DRUG APPROVALS

Source: FDA, Clarion Partners Investment Research, 2024 Q2.

With interest rates remaining elevated relative to recent history and the current under-construction pipeline still accounting for around 13% of existing stock in the three largest lab markets (Boston, the Bay Area, and San Diego), near-term challenges remain. However, the aging population, favorable trends in healthcare spending, and investments in new technologies are key long-term tailwinds for the sector. Additionally, the continued growth in R&D spending, anticipated rebound in venture capital investment, and shrinking lab construction pipelines are reasons for optimism moving forward, supporting a positive long-term view of the sector.

MEDICAL FACILITIES

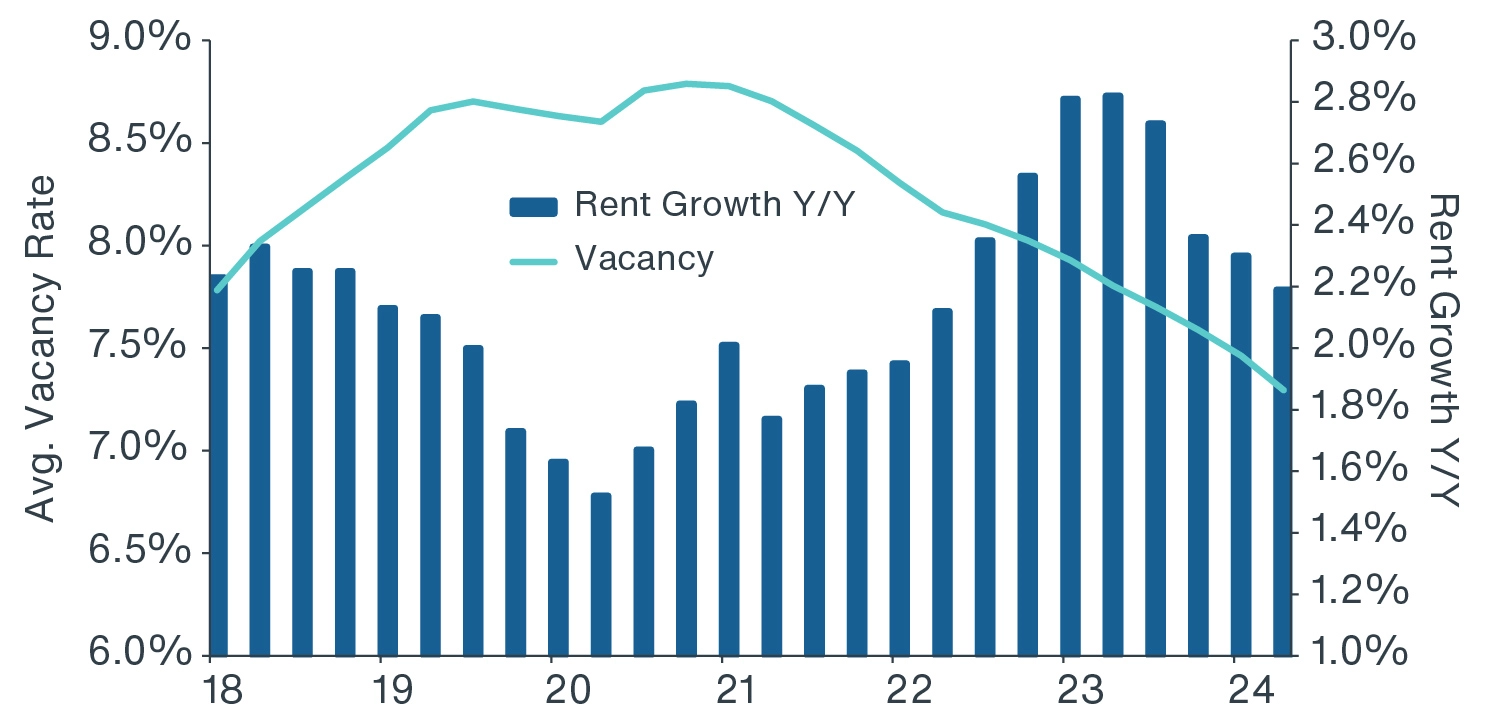

Supported by favorable demographic trends and a rise in demand for healthcare services, in part due to patients undergoing procedures that were postponed due to the pandemic, market fundamentals in the medical facilities segment remain healthy (Figure 6). The segment’s relative outperformance during the volatile post-pandemic period is consistent with its historically steady performance across economic cycles, which is due in large part to its long-term lease structure, sticky tenant base, and need-based demand drivers.

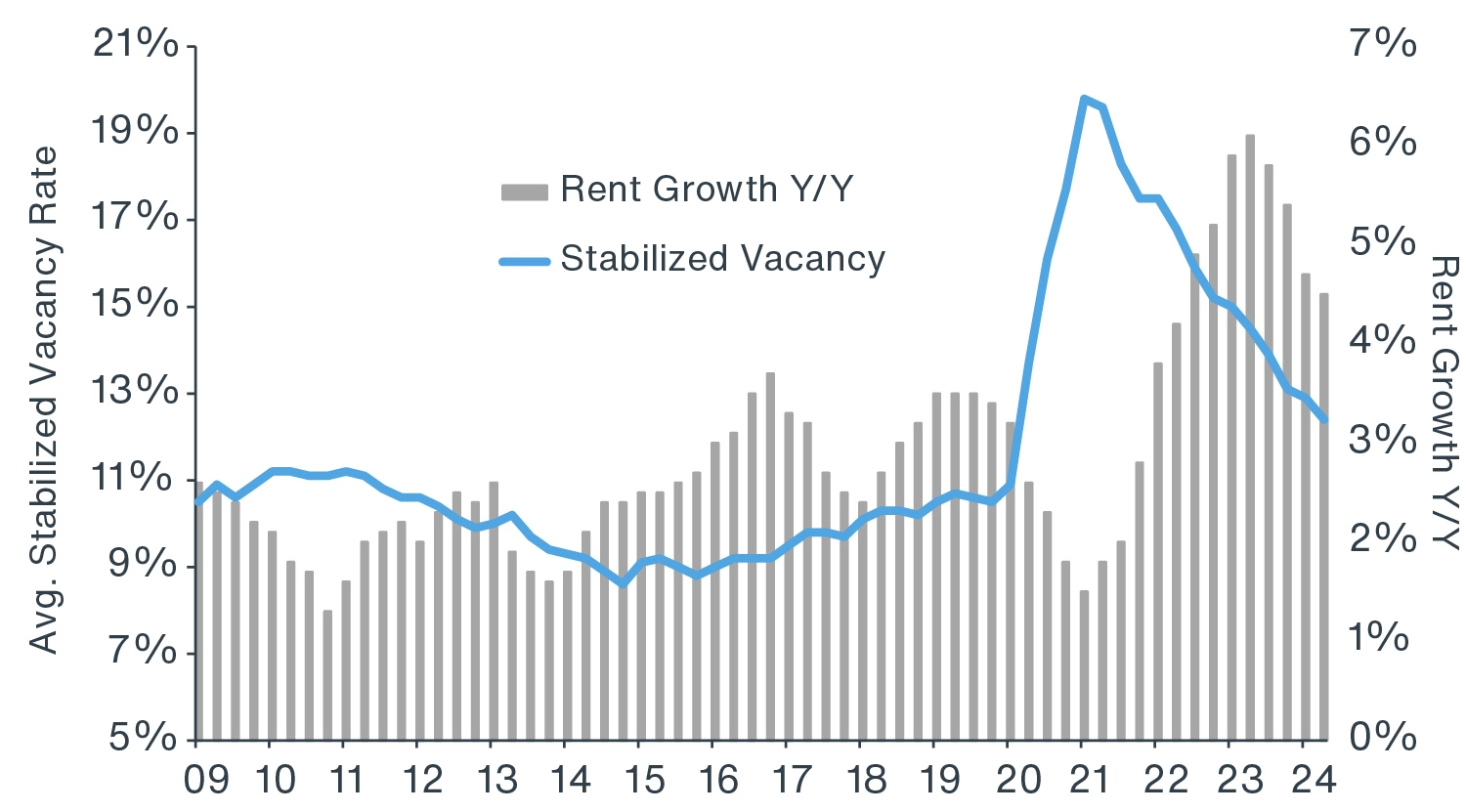

FIGURE 6: TOP 50 MEDICAL FACILITIES MARKET VACANCY & RENT GROWTH

Source: RevistaMed, Clarion Partners Investment Research, 2024 Q2.

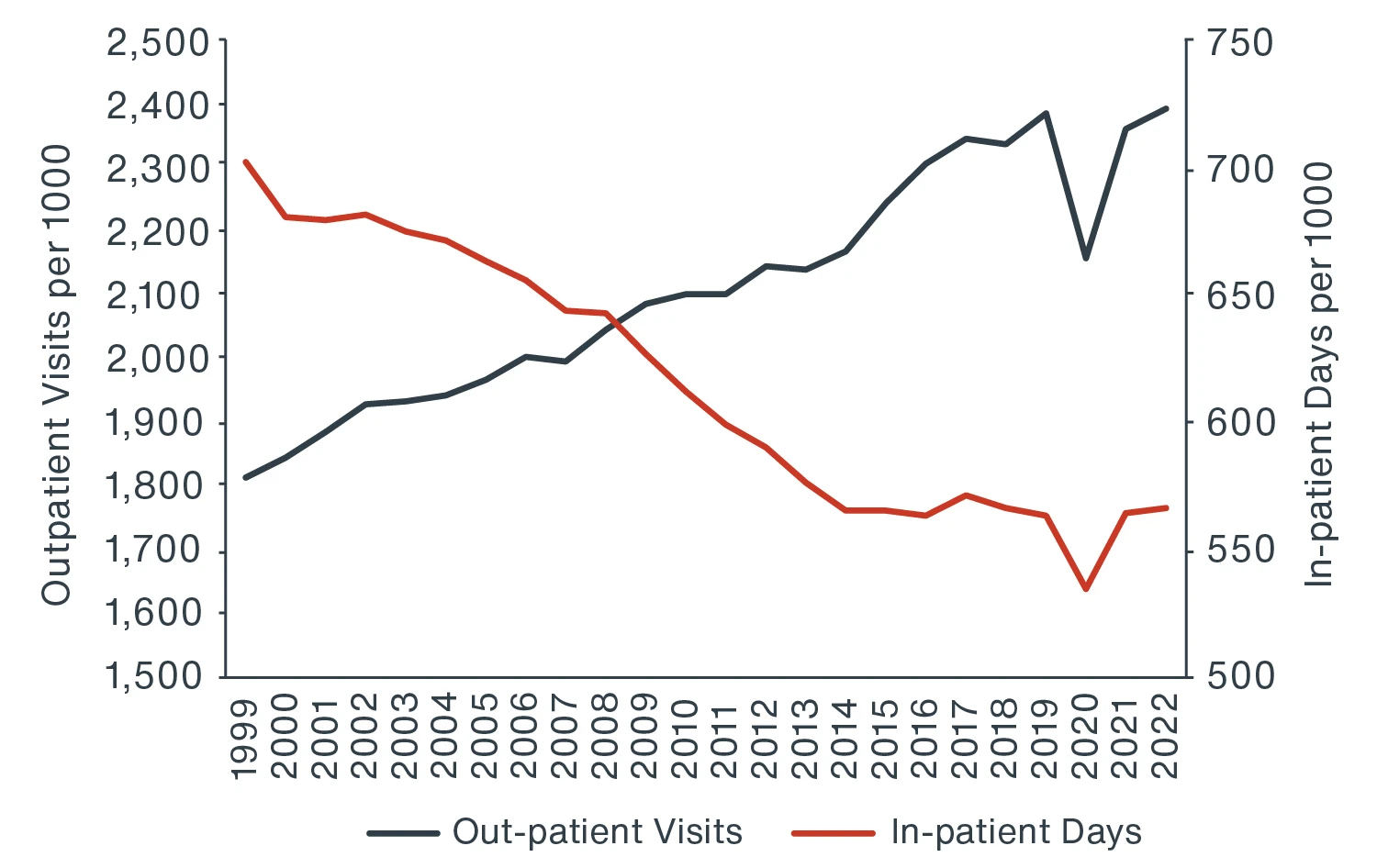

As healthcare systems look for ways to reduce costs, there has been a notable shift in medical visits from in-patient to out-patient care, which should continue to fuel medical facilities demand moving forward (Figure 7). Additionally, as the population ages, increased healthcare spending among older households should also bolster demand. At the same time, Millennial households are entering their prime household formation and earning years, which should also contribute to increased demand for healthcare services. On the supply side, construction starts have fallen in response to elevated development and borrowing costs. The anticipated lull in medical office completions in the coming years should benefit market fundamentals.

FIGURE 7: U.S. OUT-PATIENT VS. IN-PATIENT VISITS

Source: KFF, 1999-2022 AHA Annual Survey, Copyright 2022 by Health Forum LLC, Clarion Partners Investment Research, 2024 Q2.

Looking forward, the aging population and the anticipated increase in healthcare spending resulting from this demographic wave should buoy market fundamentals. Considering this demographic shift and the sector’s limited near-term supply-side pressure, the current supply/demand imbalance should persist, creating upside potential to the sector’s anticipated strong-but-steady performance over the next few years.

SENIORS HOUSING

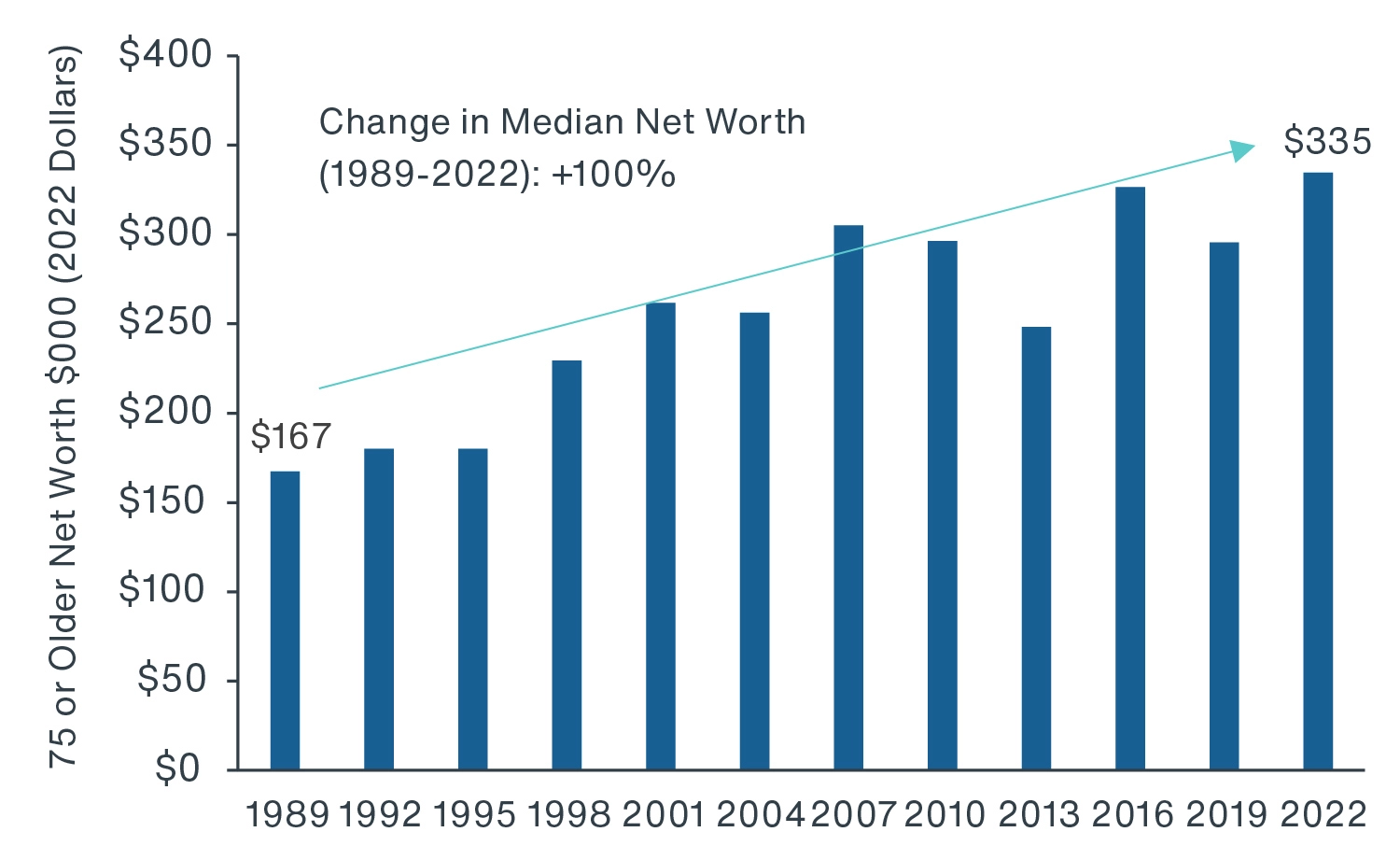

Considering the sheer size of the Baby Boomer cohort, meeting the healthcare and housing needs of this aging generation will be a challenge. The Baby Boomer generation is close to entering their 80s and, by 2044, all Baby Boomers will be over the age of 80 – the age when the demand for long-term care services becomes more acute, and this demographic tailwind should provide strong support for seniors housing demand in the coming decades. Health outcomes have improved for the country’s older-adult population, with average life expectancy for those 65 years or older rising to just under 17 years for males and close to 20 years for females.8 This longer life expectancy, combined with the size of the Baby Boomer cohort, should result in outsized demand for seniors housing relative to previous generations. Improved finances are also positive demand drivers for the sector. Supported by elevated home prices and stock portfolios, the median net worth of persons aged 75 years or older reached $334,000 in 2022, up from $296,000 in 2019, and nearly double the age cohort’s median net worth in 1989, on an inflation-adjusted basis (Figure 8). Today’s aging households are in better shape financially relative to previous generations, which should enable a greater proportion of seniors to access seniors housing and contribute to outsize demand relative to prior cycles.9

FIGURE 8: U.S. MEDIAN NET WORTH OF 75+ POPULATION

Source: Federal Reserve, Clarion Partners Investment Research, 2024 Q2.

Market conditions in seniors housing have notably improved since the depths of the pandemic. Pent-up demand has contributed to firmer market conditions, as older-adult households, many of whom had delayed the transition to senior living facilities because of COVID, are now moving. Consequently, demand for units has widely outpaced new construction, bringing occupancy levels closer to pre-pandemic norms, while penetration rates have also recovered (Figure 9).10

FIGURE 9: PRIMARY & SECONDARY SENIORS HOUSING MARKET VACANCY & RENT GROWTH

Source: NIC Map, Clarion Partners Investment Research, 2024 Q2.

Favorable structural demand trends combined with the sector’s continued post-pandemic recovery and muted near-term supply response support expectations for the sector’s continued outperformance. Signs of a cooling labor market point to improving profitability going forward, as the sharp rise in operational costs from upward pressure on wages and the limited healthcare labor pool post-pandemic has begun to subside.

OUTLOOK

Despite uneven current market conditions and near-term supply challenges in life sciences, we believe that healthcare-driven real estate is positioned to perform well over the long-run. Life sciences, medical facilities, and seniors housing are all poised to benefit from favorable demographic and innovation-related tailwinds, namely an aging population, increased investment in life science R&D, medical technology breakthroughs leading to longer life expectancies, and an expected boost to healthcare spending. Additionally, shrinking construction pipelines across all healthcare property types should support healthy market conditions. With potential interest rate cuts on the horizon, what should be a more accommodative interest rate environment over the next couple of years should further aid fundamentals and performance for these three emergent asset classes.