Executive Summary

- Trump campaigned on dramatically raising tariffs which could accelerate decoupling with China and re-ignite

trade wars.

- There is still a lot of uncertainty around tariff levels, policy timing, and the net impact to industrial markets.

- We believe regions including East and Southeast Asia (excluding China) and Mexico will continue to capture

important share, though we could also see a surge in U.S. manufacturing.

- Consumption trends have remained healthy and port volumes and e-commerce sales continue expanding,

which should support growth for U.S. industrial logistics.

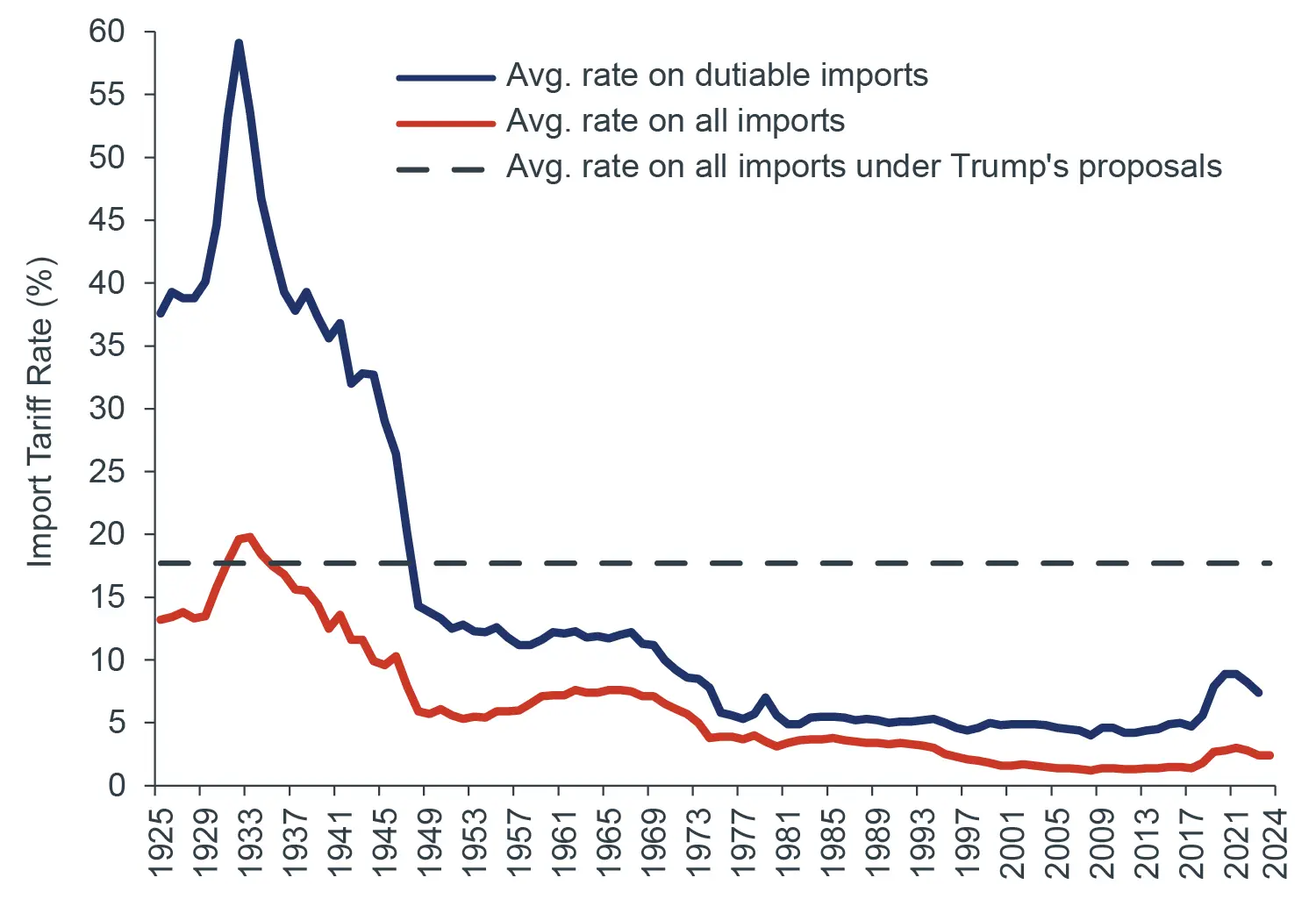

President-elect Trump campaigned on dramatically raising tariffs

to 10%-20% on all trading partners, including Mexico, Canada,

and the E.U., and has also notably threatened to increase tariffs

on the $500 billion of annual imports from China to as high

as 60%.1

This would be an escalation of the first set of Trump

tariffs that were held in place by the Biden administration and

even expanded at certain points. However, the new proposal is

substantial and could accelerate the decoupling between the

world’s largest manufacturing and consumption superpowers and

re-ignite trade wars.

There is still uncertainty around what the Trump administration

will do, the level of tariffs, policy timing, and the net impact to

industrial markets, but a drastic rise in tariffs (to levels not seen

since the Great Depression) would almost certainly have a ripple

effect on multiple layers of the economy, including inflation,

consumption, investment, interest rates, exchange rates, and

overall domestic output.

HISTORICAL U.S. TARIFF RATE

Source: The Tax Foundation, November 2024.

While the impacts could be both positive and negative depending

on the industry and its position within the economy, the net risk

could be mostly negative because of trade retaliation, business

uncertainty, and consequential inflation. What could this mean for the industrial and logistics sector? It is our view that certain

regions will continue to capture import share, including East and

Southeast Asia (excluding China) and Mexico, and we could also

see a surge in U.S. manufacturing investment, both of which

should continue supporting growth for the U.S. logistics market.

LOOKING BACK FOR DIRECTION

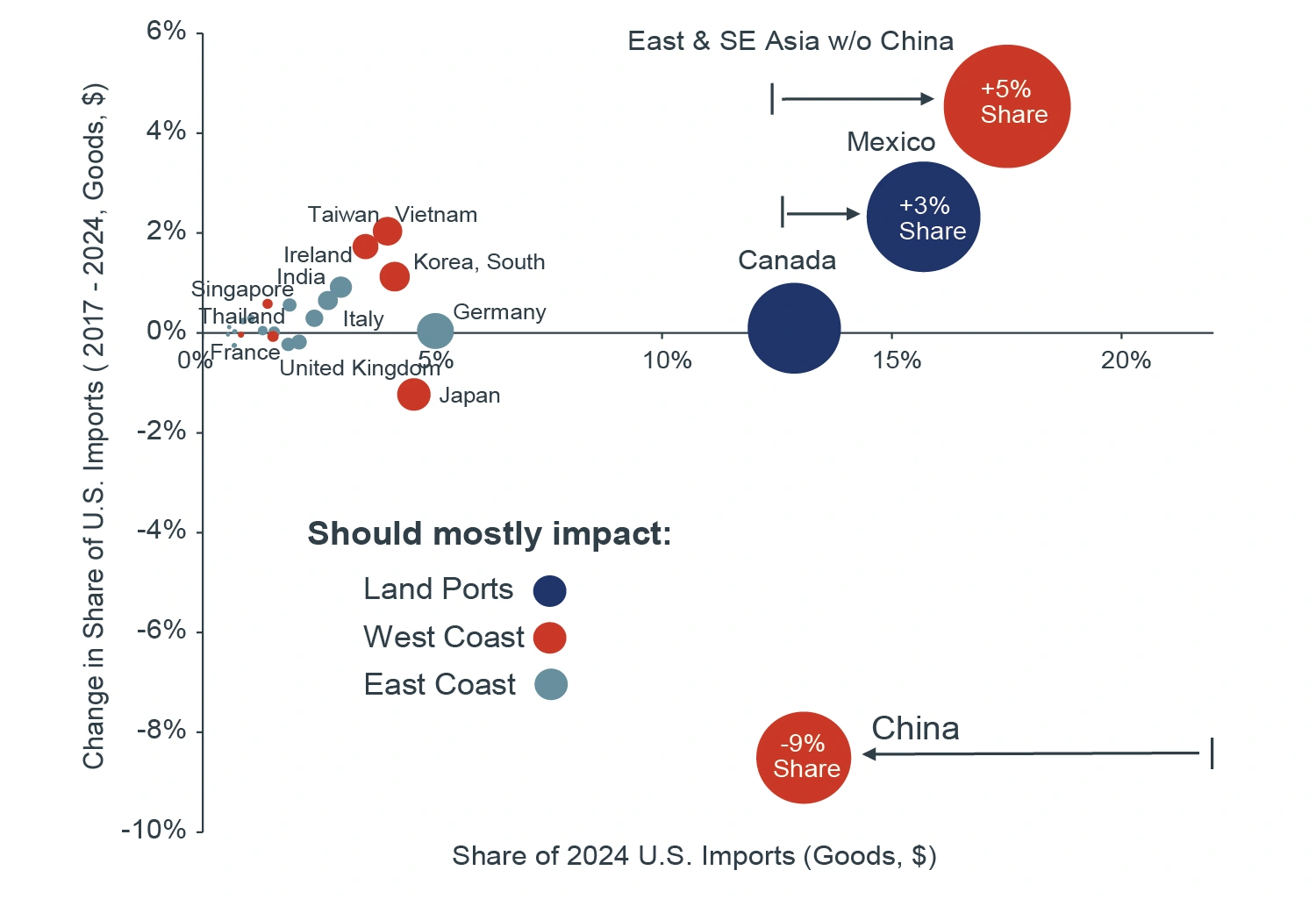

Recent ‘trade war’ policies added up to an estimated $79 billion in

annual tariffs, most of which came from China. As a result, China

has lost a nearly 9% share of U.S. imports (goods) since 2017, or

a 30% decline in import dollar volume when adjusted for inflation.2

SHARE OF U.S. IMPORTS BY COUNTRY

Source: U.S. Census Bureau, Clarion Partners Investment Research, October 2024

This effectively knocked China from the top importer position

it held for over 14 years and cleared the way for Mexico (+3%

import share gained, +26% gain in real dollars) and other East

and Southeast Asian countries (collectively +5% share, +35%

gain in real dollars) to capture share. The response from Chinese

firms has been noteworthy with the rise of Asian 3PLs in the U.S.,

the shipping of smaller packages directly to consumers from

China (below taxable threshold), and investments into assembly

and logistics facilities outside of China in places like Mexico – all of which are likely an attempt to avoid or reduce additional costs brought on by tariffs. Despite the shift in trade volumes, these developments and a resilient U.S. consumer have lessened the negative impact on the U.S. industrial market.

The shift in trade patterns has also stirred discussions about

industrial demand, market selection, and the long-term viability

of existing gateways. It remains our view that while a decoupling

or material reduction in trade with China could negatively impact

near-term demand in markets like Southern California, the sharp

rise observed in trade with East and Southeast Asia (excluding

China) could soften the shortfall and preserve occupancy in

gateway markets. Additionally, the perceived risk of higher

tariffs, along with other possible supply chain disruptions like the

recent port strikes, appears to have started a push to stockpile

inventories which could subsequently improve warehouse

utilization and warehouse demand as firms try to minimize supply

chain disruptions. This may result in increased reliance on third-party logistics across a broader range of tenants as they look to

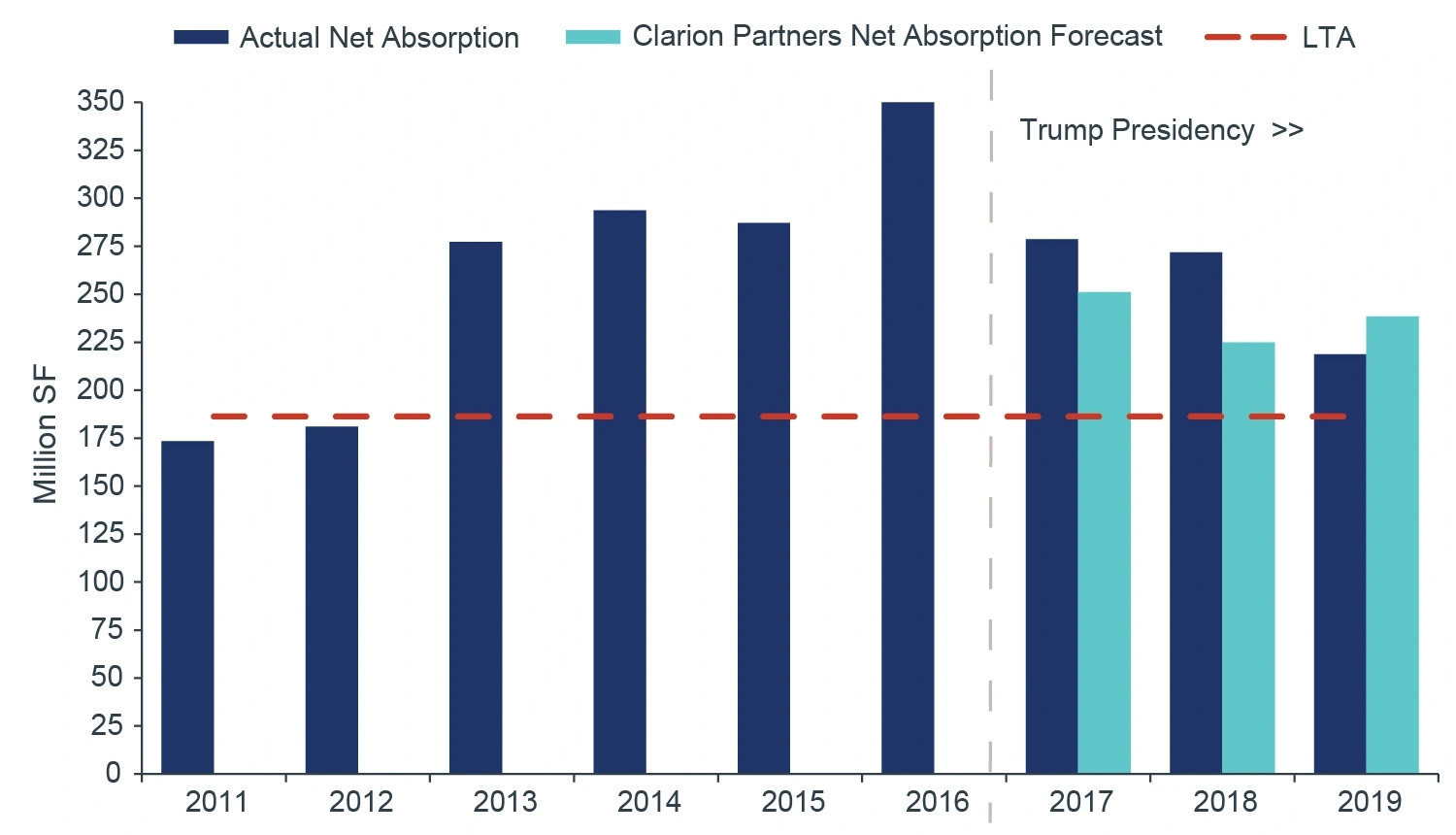

outsource the complexity of supply chain logistics. In fact, actual

net absorption was higher in 2017 and 2018 than we originally

expected, which is when the initial Trump tariffs were put in place.

U.S. INDUSTRIAL NET ABSORPTION

Source: CBRE-EA, Clarion Partners Investment Research, Q3 2024

The market remained above Long Term Average (LTA) net

absorption while vacancy rates remained near record lows

through 2019 given the resiliency of the U.S. consumer and

including robust e-commerce sales growth.3

Mexico’s proximity to the U.S. market and appealing relative

manufacturing costs have positioned the country to benefit as a

viable near-shore alternative. Today, Mexico is the largest source

of imports into the U.S. This has increased the investor appeal

for markets like El Paso, Texas, which have seen notable growth

recently.4

Despite increased attention to these rapidly growing

small border markets, our analysis of GPS logistics transportation

data suggests that incoming goods from Mexico largely flow

through established markets, such as Dallas-Fort Worth and

Houston, but also less obvious markets like Phoenix, Southern

California, and several U.S. Southeast and Midwest markets

given their logistics infrastructure and demographic reach. Similar

markets are also a top origin of exports to Mexico, often for

intermediary goods that are part of a greater bilateral value-add

manufacturing supply chain. We believe investment in these

more established markets provides exposure to growing Mexico

manufacturing (see markets table on the right).

SCENARIO A: A CONTINUATION

Under this scenario tariffs are increased modestly, and the

decoupling trend continues, impacting import growth rates

similarly to what has been observed since the initial Trump

tariffs. We estimate that China imports continue decreasing at an

average annual rate of 5%, or just over 20% over the next five

years. This would decrease China imports to levels not seen since

the early 2000s, effectively erasing more than a decade of growth

after adjusting for inflation.

Making the same continuous growth assumption, however, for

East and Southeast Asia (excluding China), or 5.5% growth

annually and just over 30% over five years, would more than

offset the drop-off from China. After all, the region’s import dollar

volume has remained above China’s since 2022.5

Mexico would

also be poised to see volumes grow more than 20% over five

years, keeping it at the top position by individual country and likely

benefiting the markets mentioned earlier.

Source: Clarion Partners Investment Research, U.S. Department of Transportation, International Trade Administration,

Advan, Q3 2024. Southern California includes Los Angeles, Riverside, San Diego, and Orange County. First column is

based on imports through Otay Mesa, El Paso, and Laredo.

SCENARIO B: AN ESCALATION

A scenario where all imports from China see a 60% tariff could

have a drastically different outcome. Building from the changes

seen since 2017, a 60% tariff would mean four to five times the

tariff cost burden on Chinese suppliers, importing U.S. companies,

and possibly consumers to the sum of $250 billion based on 2023

goods imports, equivalent to roughly 3% of U.S. total retail sales.6

While East and Southeast Asia (excluding China) and Mexico

should continue to capture growth as sourcing diversifies, it could

be disproportionate to recent periods given the possible tariffs

that each could face and their inability to respond to those levels

quickly given time and cost constraints. This could also accelerate

India’s export market given its relative low-cost structure and large

workforce. It is also worth noting that the Chinese government

is likely to step in with support (fiscal, monetary, exchange

rate controls, and regulatory policies) given the importance of

manufacturing and exports for Chinese GDP growth.

U.S. domestic manufacturing is likely to see considerable

growth and investment through policies and subsidies under

this scenario, but this will likely be focused on high value-add

industries and will come with a lag. Adding this level of capacity

to U.S. manufacturing would require a substantial amount of

time and hefty investment into areas like automation, ultimately

forcing companies to absorb much of the tariff cost in the interim

at different points of the supply chain. At least a portion of those

costs would likely be passed on to consumers through price

increases. The long-term impact depends on which policies

remain in place after 2028 and the severity of the bilateral fallout

between the U.S. and its import partners as well as the economic

impact.

CONCLUSION

U.S. consumption ultimately drives growth for industrial and

logistics real estate, and it has remained resilient over the last

six years despite historically higher tariffs and inflation, as well

as elevated interest rates and macroeconomic uncertainty. Real

retail sales have increased 20% since 2017 with real e-commerce

sales alone doubling over the same period.7

This has supported

rapid growth in import TEU volumes and lifted the ratio of both

e-commerce sales as a percentage of retail and real e-commerce

sales per industrial square foot. If consumption continues on a

healthy path, the growth prospects for industrial remain bright.

However, a pullback in consumer spending from inflation or an

economic slowdown could have a short-term negative impact

on the market. While there is a wide range of uncertainty on

future policy, it is our view that certain regions should continue

to benefit from the U.S. / China decoupling, including East and

Southeast Asia (excluding China) and Mexico. We also expect

additional growth in U.S. manufacturing investment which should

benefit the warehouse sector. Additionally, consumption trends

have remained healthy and port volumes and e-commerce sales

continue expanding, all of which should support growth for the

U.S. industrial logistics market.