INTRODUCTION

This paper, the third in our series, explores why European Sale and Leaseback (SLB) investments are especially compelling at this point in the economic cycle. With appealing day-one income yields, a strong deal pipeline, and a favourable macroeconomic environment, we believe European SLBs offer an attractive opportunity for investors.

WHY NOW: SLBs OFFER ATTRACTIVELY PRICED LIQUIDITY

Limited Financing Availability and High Costs Drive SLBs

Corporates are looking to unlock cash equity from their real estate assets at a time when access to traditional financing is expensive and selective. The latest Eurozone lending survey reveals that banks further tightened credit standards for loans in the second quarter of 2024. While the rate of tightening has slowed, the cumulative effect over the past two years has been significant, leading to a near-stagnation in corporate lending growth, which was just 0.8% year-on-year in August 2024. Meanwhile, the cost of borrowing for new loans to non-financial corporations in the Eurozone remains historically high, hovering above 5%.1

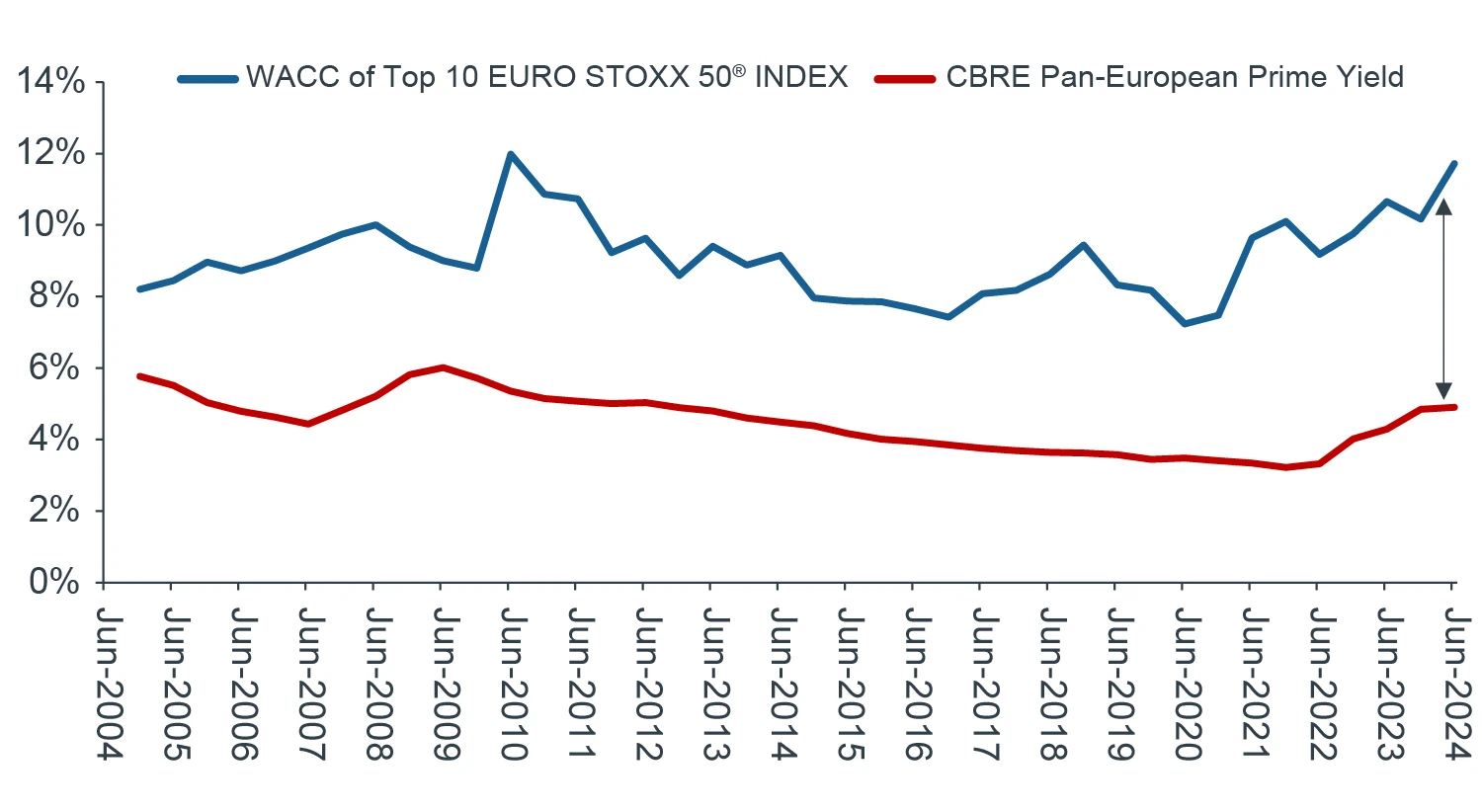

Bond issuance has rebounded from the lows of 2022, driven by renewed investor optimism and improved access to markets for sub-investment grade credit. However, the cost of issuance remains elevated, with the average coupon for B-rated European bonds standing at 7.9%, an expensive source of capital.2 Figure 1 illustrates that for European corporations, the potential cost of financing through SLBs as measured by property yield, is significantly lower than their Weighted Average Cost of Capital (WACC).

Therefore, for a large number of corporates where real estate is the cost of doing business, there is a large incentive to sell and lease back their real estate portfolios and invest proceeds for other business purposes.

In the current liquidity-constrained macroeconomic environment, a SLB transaction enables companies to convert illiquid assets into cash, freeing up capital that can be redeployed into higher-return investments, such as R&D, strategic acquisitions, or operational expansion, yielding a greater return on equity. Additionally, the ability to monetise fixed assets at market value enhances liquidity metrics, improves asset turnover ratios, and can lower the weighted average cost of capital (WACC), especially when debt financing remains expensive. In the current financing environment, SLB strategies make sense for a lot of European corporates who are often holding valuable real estate assets.

FIGURE 1: SLB IS A COST-EFFICIENT FORM OF FINANCING FOR CORPORATES

Source: Bloomberg, CBRE, Clarion Partners Investment Research.

The Recovery in M&A Activity Could Propel SLBs

Mergers and Acquisitions (M&A) activity has traditionally been a strong driver of SLB transactions, as private equity (PE) firms often seek to sell and lease back the real estate portfolios of target companies to finance acquisitions. The M&A market is showing signs of recovery, with European deal volume reaching $255 billion in the first half of the year—a 23% increase compared to the same period last year.3

A significant tailwind for M&A activity is the record level of private equity dry powder, which soared to an unprecedented $2.6 trillion as of July 2024.4 This accumulation reflects a slow year in dealmaking, with limited opportunities for firms to deploy capital raised in previous years.

Moreover, PE firms are under pressure to realize returns for investors. As of the beginning of the year, PE firms held more than 27,000 portfolio companies globally, about half of which had been held for at least four years—typically the point at which they are primed for exits.5

WHY NOW: ATTRACTIVELY PRICED RELATIVE TO FIXED-INCOME

SLB investments are often regarded as the most bond-like among property assets, thanks to their returns being driven by secured, contracted income and income indexation. Over the past 12-18 months, rising interest rates have caused real estate yields to widen.

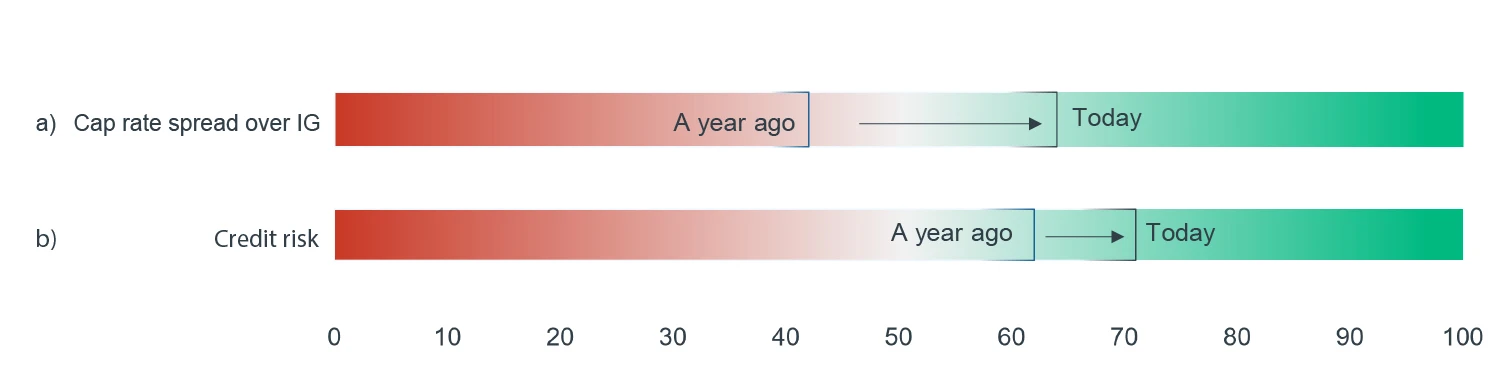

The yield shift has helped restore the yield premium relative to fixed-income alternatives. This is illustrated in Figure 2, which uses a 0-100 scale to compare the spread of European cap rates over Investment Grade credit, both today and a year ago, within a historical context.

FIGURE 2: EUROPEAN REAL ESTATE ATTRACTIVELY PRICED WHILE CREDIT OUTLOOK IMPROVES

Source: Green Street, BofA, Clarion Partners Investment Research, as of July 2024. Note: Credit risk is measured by European HY spreads. Metrics shown as z-scores rescaled to 0-100. Period analysed is from January 2007 to July 2024.

WHY NOW: STRONG CREDIT OUTLOOK FAVORS SLBs

Improving Credit Outlook

In SLBs, a larger portion of the investment value is tied to the lease and income stream compared to other lease structures, making the credit component a key driver of returns. While default rates have risen recently, they remain well below levels seen during the pandemic and the Global Financial Crisis.6

Going forward, credit risk, as proxied by corporate yield spreads (Figure 2b), is improving as monetary policy normalizes and the economy appears headed for a soft landing. However, thorough credit underwriting remains essential to managing tenant default risk in SLBs. This can be achieved by focusing on tenants with resilient credit profiles and on "mission-critical" assets which are essential to a tenant’s operations.

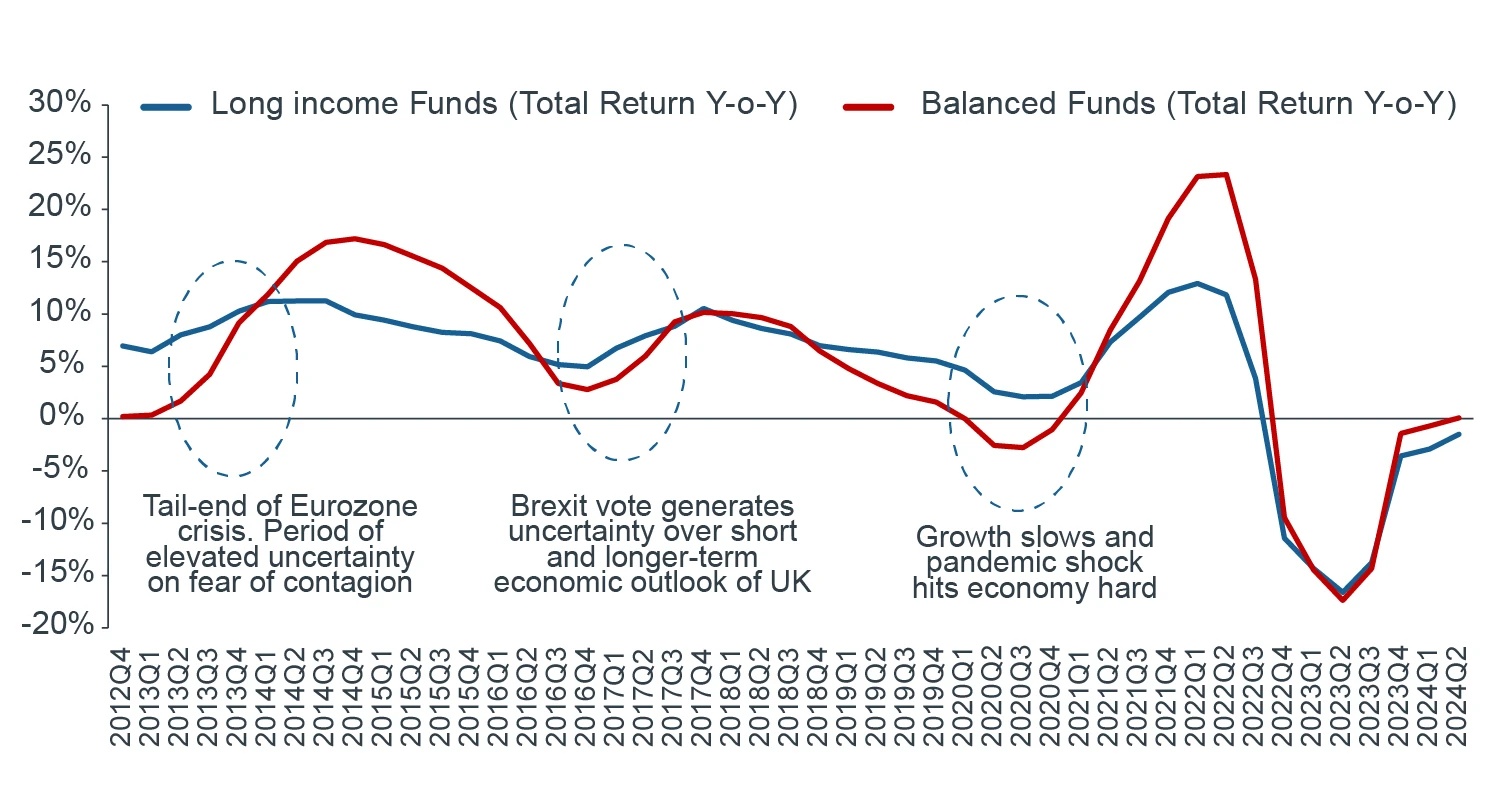

SLBs are particularly attractive during economic uncertainty due to their defensive characteristics. Historically, the MSCI/AREF UK Long-Income Index shows that this type of investment has performed relatively well during major events such as the Eurozone crisis, Brexit vote aftermath, and the COVID-19 pandemic (Figure 3).

FIGURE 3: LONG-LET PROPERTY HAS PERFORMED RELATIVELY WELL AT TIMES OF ECONOMIC UNCERTAINTY/STRESS

Source: MSCI, Clarion Partners Investment Research.

Falling Interest Rates and Normalising Rental Growth

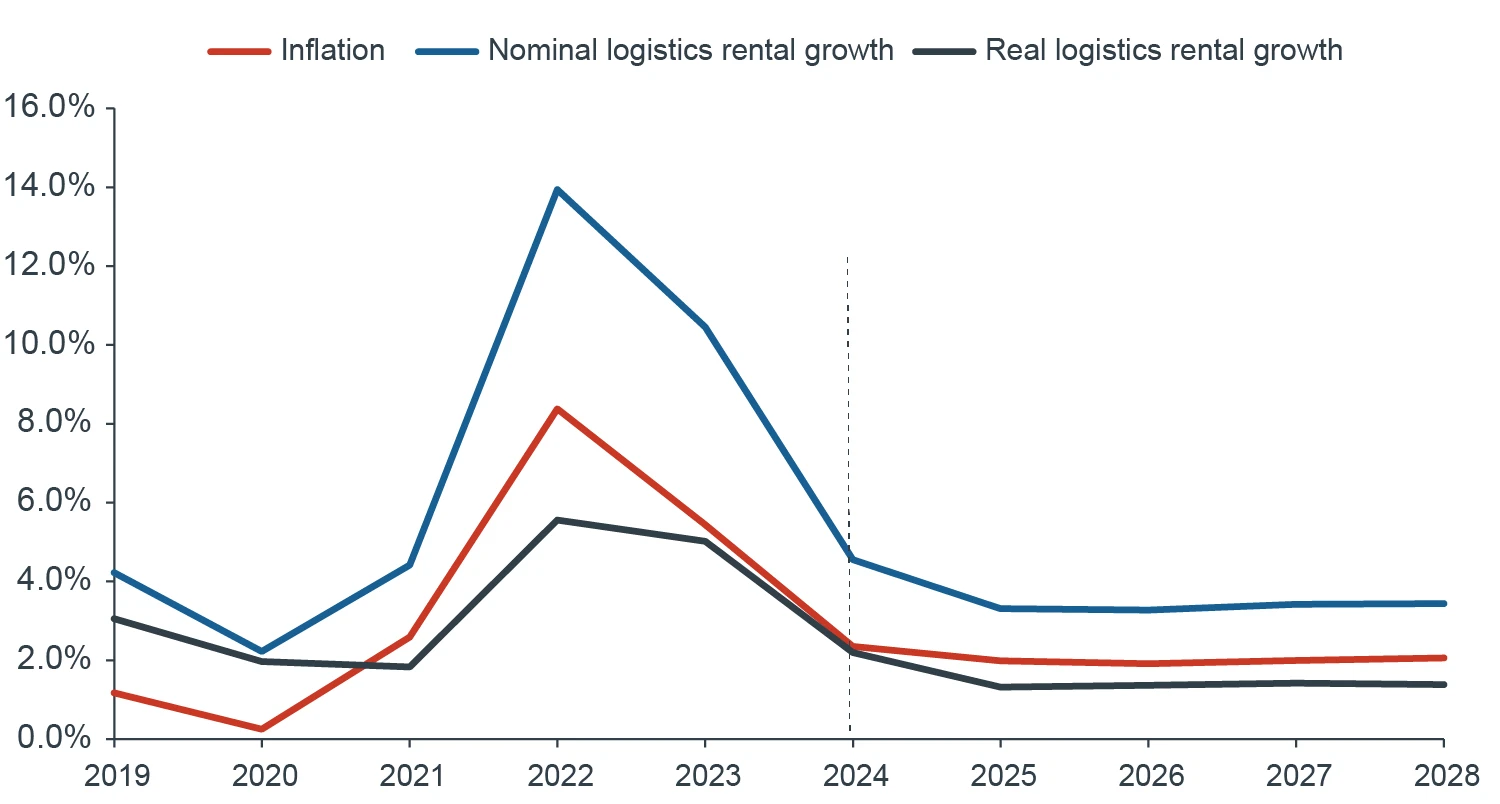

As interest rates and property yields start to decline from their current elevated levels, the long leases typically associated with SLB transactions allow investors to lock-in attractive income yields for the longer term. Moreover, with rental growth expected to align more closely with inflation in the future even in strong sectors such as logistics (Figure 4), SLBs' long, inflation-linked cash flows are, in our view, becoming increasingly attractive compared to shorter-lease structures. These cash flows also provide a strong hedge against unexpected inflationary shocks and broader macroeconomic pressures, including those driven by decarbonization, demographic changes, and regionalization.

FIGURE 4: RENTAL GROWTH EXPECTED TO ALIGN MORE CLOSELY TO INFLATION GOING FORWARD

Source: CBRE, Clarion Partners Investment Research. Note: rental growth is unweighted average of France, Germany and the Netherlands.

CONCLUSIONS

We believe that the European SLB market is ripe for investment. Several factors are aligned in creating a fertile environment for corporates to unlock cash from their real estate. Assuming that interest rates continue to decline and rental growth continues to moderate, we believe that SLBs are well-positioned to benefit compared to other investment strategies. This combination of favourable market conditions makes European SLBs a compelling investment opportunity for real estate investors, offering the potential for robust, risk-adjusted returns while also providing portfolio diversification benefits.