WHY EUROPEAN LOGISTICS?

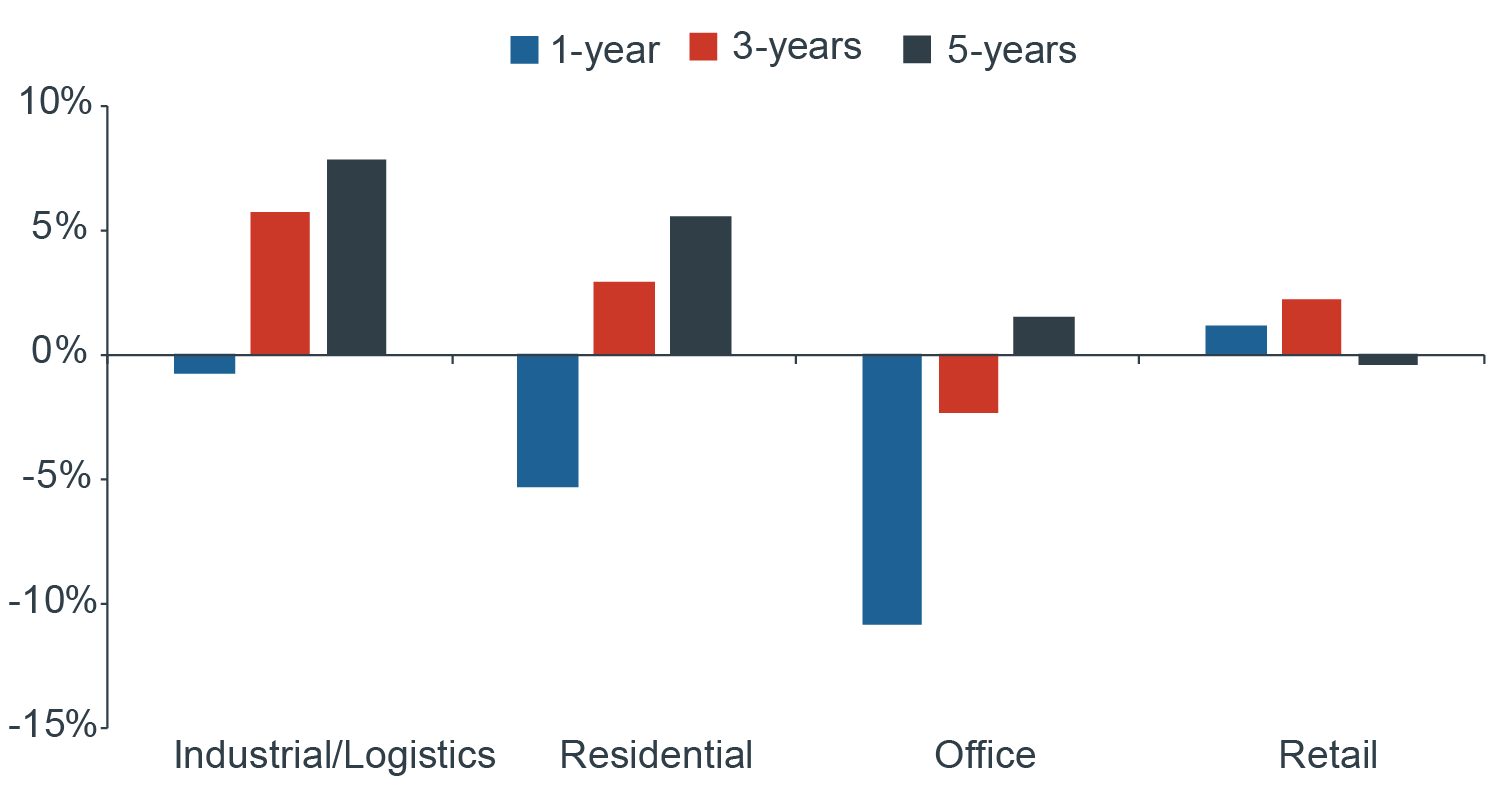

During the previous property cycle, the European logistics sector emerged as a standout performer, driven by robust fundamentals and enduring demand trends. The sector comfortably surpassed benchmarks and other mainstream property sectors (Figure 1). Capital flows into the sector surged, with logistics properties reaching a record high of 21% as a share of total private European investment in 2023, up from approximately 10% a decade earlier.1

FIGURE 1: INREV ANNUALISED ASSET LEVEL TOTAL RETURN, AS OF Q4 2023

Source: INREV, Clarion Partners Investment Research, Q4 2023.

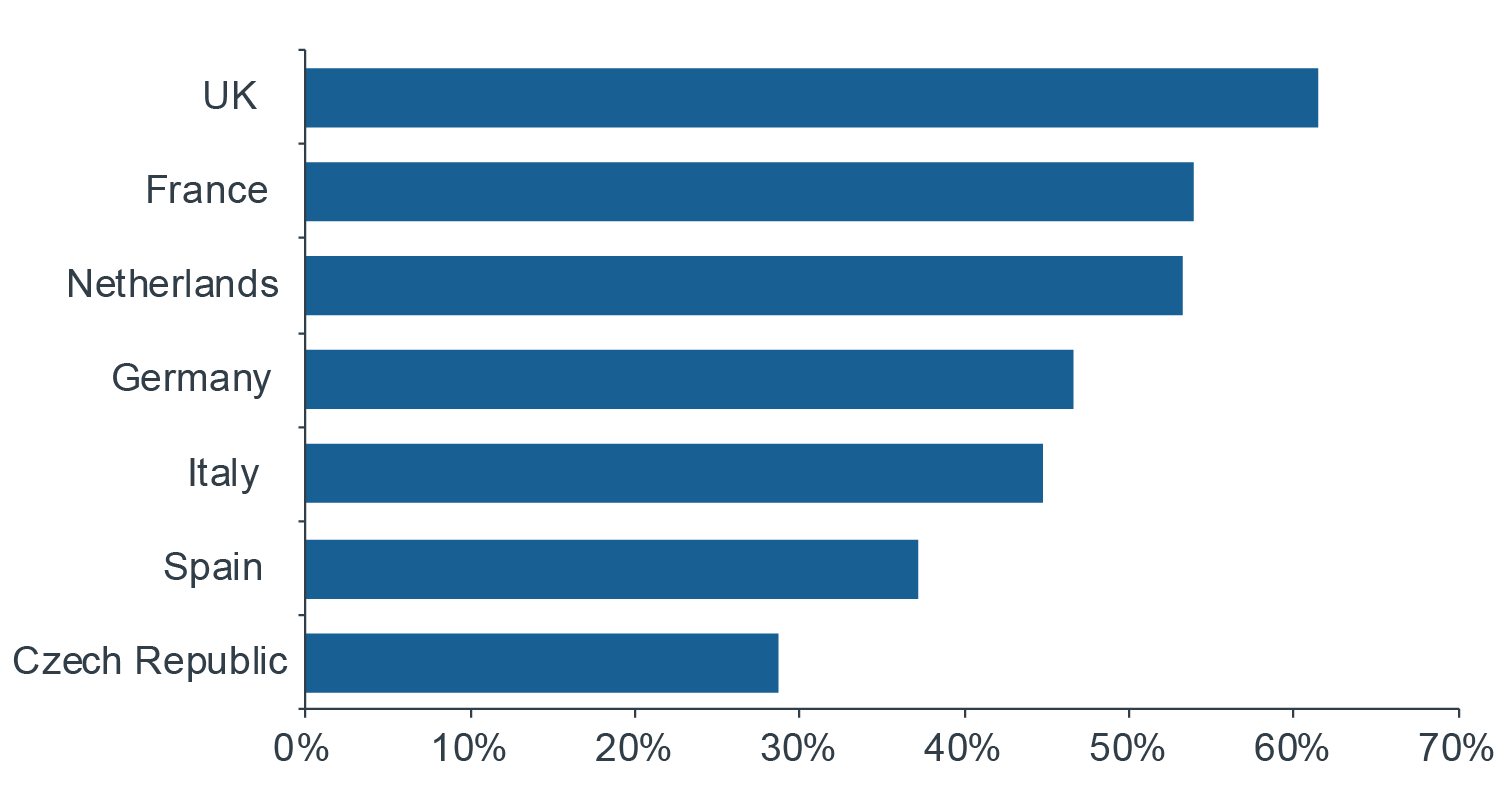

Over the past two years, the sector has returned to more typical demand levels with the lockdown-induced frenzy slowing. Despite this, the structural drivers of logistics remain largely unchanged and Clarion Partners Europe maintains a positive outlook for the sector's long-term prospects. This, together with the interest rate induced material repricing since mid-2022 (Figure 2) presents a rare and appealing opportunity to invest in these enduring trends.

FIGURE 2: % PRIME YIELD CHANGE - PEAK TO APRIL 2024

Source: CBRE, Clarion Partners Investment Research, April 2024.

In this research paper, we delve into the strategic and tactical considerations that reinforce our confidence in European logistics property. We highlight our growing confidence in 2024 and 2025 to potentially be highly attractive periods for investment in European logistics.

COMPELLING FUNDAMENTALS

Throughout the past decade, logistics rental rates in Europe have grown consistently, surpassing the four-core sector average and inflation rates significantly. On a nominal basis, prime headline logistics rents in Europe have increased by 67% on average between 2013 and 2023.2

After years of double-digit growth, rental growth has moderated lately amid a normalization of demand and an uptick in vacancies. However, market fundamentals remain compelling. At 4.2%, the European vacancy rate was still below its long-term average of 4.9%3 as of Q1 2024. While occupier demand has softened in the current economic climate, the European economy seems to be headed for a “soft-landing” and therefore we are cautiously optimistic on the outlook for demand over the next 6-12 months.

Furthermore, development pipelines have shrunk in numerous markets due to heightened construction costs and financing challenges, leading us to anticipate a slowdown in new supply from 2024 onwards. Particularly noteworthy are the substantial declines in speculative development pipelines in countries such as France (-74%), the UK (-55%), and the Netherlands (-42%).4 As the economy rebounds, we also anticipate the re-absorption of much of the tenant-controlled "grey-space." Consequently, vacancy rates are projected to persist below their long-term averages over the next five years (as depicted in Figure 3), fueling rental growth.

FIGURE 3: VACANCY RATE FORECASTS FOR SELECTED CORE WESTERN EUROPEAN MARKETS

Source: Clarion Partners Investment Research, Q1 2024.

Logistics and industrial remains well-supported by structural demand drivers. The key drivers of industrial – e-commerce and trade – continue to remain structurally important within the global economy and will remain powerful catalysts of demand for the sector.

E-COMMERCE

Innovation and technology have played a pivotal role in the rapid growth of e-commerce, which has become an integral aspect of how societies engage in consumption. Each age group has distinct consumption preferences that are increasingly being met through e-commerce platforms supported by logistics and warehouse infrastructure. This substantial shift in consumer behavior was significantly accelerated by the COVID-19 pandemic, as more individuals turned to the convenience and safety of online transactions.

Logistics assets, serving as critical infrastructure for this e-commerce surge, experienced a notable increase in occupier demand. However, as restrictions lifted and people returned to physical stores, e-commerce spending moderated. This resulted in a temporary pause in expansion plans for e-commerce companies, leading to a reassessment of their distribution strategies. In 2024, there are indications that e-commerce demand is increasing and the sector will soon return to being a net absorber of warehouse space.

We anticipate that e-commerce will continue to be a substantial driver of the industrial and logistics sector, particularly as the tech-savvy Millennial and Gen Z cohorts, known for their "on-demand" preferences, enter their peak spending years. The penetration rate of e-commerce varies by country, ranging from 9% to 27%, indicating significant potential for catch-up growth in certain markets.5

Assuming annual growth rate of 10-15%, the e-commerce market for goods in key Western European markets of Germany, France, the Netherlands, and the UK is expected to expand by €170-290 billion over the next five years.6 Considering that approximately 90,000 square meters of additional warehouse space is estimated to be needed for every additional €1 billion in e-commerce sales,7 these markets may need a combined 3.1 million sqm pa of additional logistics/warehouse space over a 5-year period to support this spending, with the UK expected to be needing the most. To put things in context, this incremental growth equates to approx. 30% of these markets combined total net absorption at 2019 rates.

SHIFTING GLOBALIZATION AND SUPPLY CHAIN RESILIENCY

For more than four decades, the global economy has experienced significant benefits from increasing globalization and the resulting growth in trade. However, in recent years, geopolitical tensions and various disruptions such as pandemics and natural disasters have posed threats to established supply chains. Consequently, many businesses are now seeking to reduce these risks by implementing strategies such as diversifying their supplier base and decentralizing production.

A recent survey8 indicates that 50% of the surveyed occupiers agree or strongly agree that there will be a substantial increase in reshoring of production and assembly activities from China/Asia to Europe within the next three years. The low-cost manufacturing and labor markets in Eastern Europe are generally considered to be the most attractive options for onshoring or nearshoring to cater to the European market.

These strategies align with the objectives of European governments, which are eager to strengthen local manufacturing, distribution, and employment while reducing reliance on trading partners in strategic, high-value industries. Some countries and regions are already beginning to see the benefits of their inward-investment policies. For instance, some federal states of East Germany have recently unveiled several large-scale investments in the semiconductor and car battery industries, indicating the positive impact of these strategic initiatives.

SUSTAINABILITY & SCARCITY OF MODERN STOCK

A growing emphasis on sustainability regulations and tenant demands is prompting investors to focus more on sustainable assets. Even during a time when occupiers are focused on cost, newly-built spaces accounted for 50-60% of total takeup in France and Germany, and approximately 70% in Italy and the UK during 2023. In contrast, stock less than 5 years old makes up around 25% of total stock in these jurisdictions.9 We believe that the relative imbalance between demand and supply of ESG-compliant stock will benefit owner of newer assets. Some of the latest technologies being deployed in logistics assets include skylights and energy-efficient lighting, water conservation measures, solar power capture and storage, and electric vehicle (EV) charging infrastructure.

Europe is leading the adoption and implementation of Environmental, Social, and Governance (ESG) practices globally. Many European countries are introducing more stringent minimum energy standards and reporting requirements. The Global Real Estate Sustainability Benchmark (GRESB) is an industry-led organization that provides standardized and validated ESG data for the real estate sector, now mandated by financial regulations. In 2023, participation in ESG funds reached the highest level on record; however, this varied significantly by country. Out of the 2,084 funds tracked, 1,013 are in Europe and 555 are in the Americas. Europe saw the highest number of new participants last year, although there was also steady growth in the U.S.

Asset repricing indicates a promising tactical outlook for returns. With the backdrop of the sector's compelling long-term drivers, we believe that the recent material repricing in private European Commercial Real Estate (CRE) can present a compelling opportunity to enter the market.

CONCLUSION OF THE YIELD REVALUATION PHASE

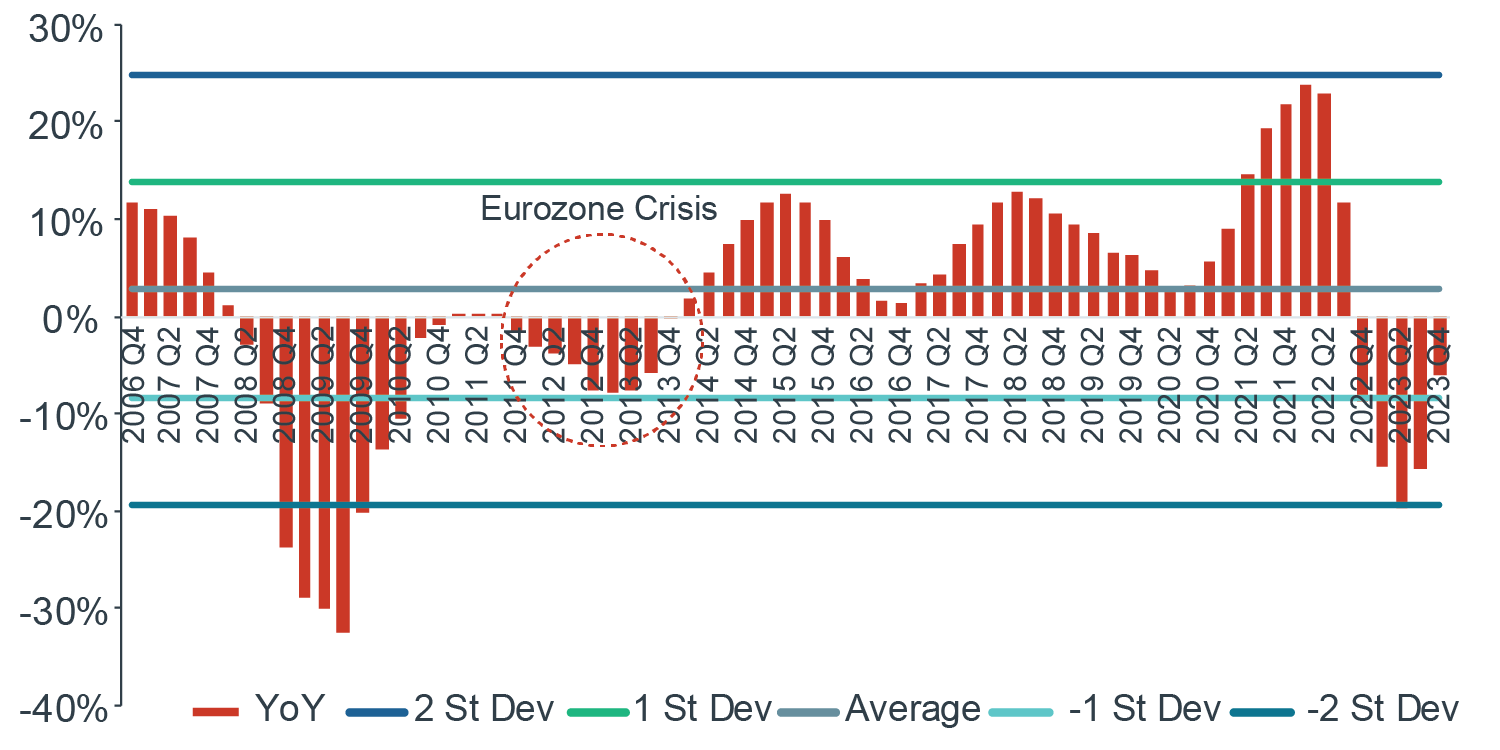

Logistics properties have been the core sector in Europe to undergo the fastest repricing since the beginning of the latest cycle of interest rate hikes. According to INREV Industrial & Logistics Asset Level Index, valuations have decreased by approximately 21% since their peak as of Q4 2023, compared to a 16% decline for the wider index. Notwithstanding a modest decline in capital growth during Q4 2023, valuations have shown signs of stabilizing over the past few quarters, indicating that values may be approaching or reaching their cyclical bottom.

As depicted in (Figure 4), which looks at capital growth at the European fund level for which longer data series are available, asset value adjustments of this magnitude (up to 2 standard deviations below the long-term average) are statistically rare and typically precede periods of sustained capital appreciation. Following the Global Financial Crisis (GFC), recovery was delayed by the Eurozone crisis of 2012-2013, but by 2014, capital growth had turned positive and accelerated thereafter.

FIGURE 4: INDUSTRIAL FUND LEVEL CAPITAL GROWTH (12-MONTH TRAILING)

Source: INREV, Clarion Partners Investment Research, Q4 2023.

While pinpointing the exact bottom of the market is challenging, we believe there is an opportunity in this phase of the cycle to acquire logistics assets at competitive prices, with significant potential for upside appreciation. We expect that the most attractive risk-adjusted opportunities will likely emerge first in core Western European markets, where capital markets have been quicker to adjust and where debt capital markets are likely to be first to loosen. Other regions such as Southern Europe and Central and Eastern Europe (CEE) are anticipated to follow suit as the process of price discovery continues.

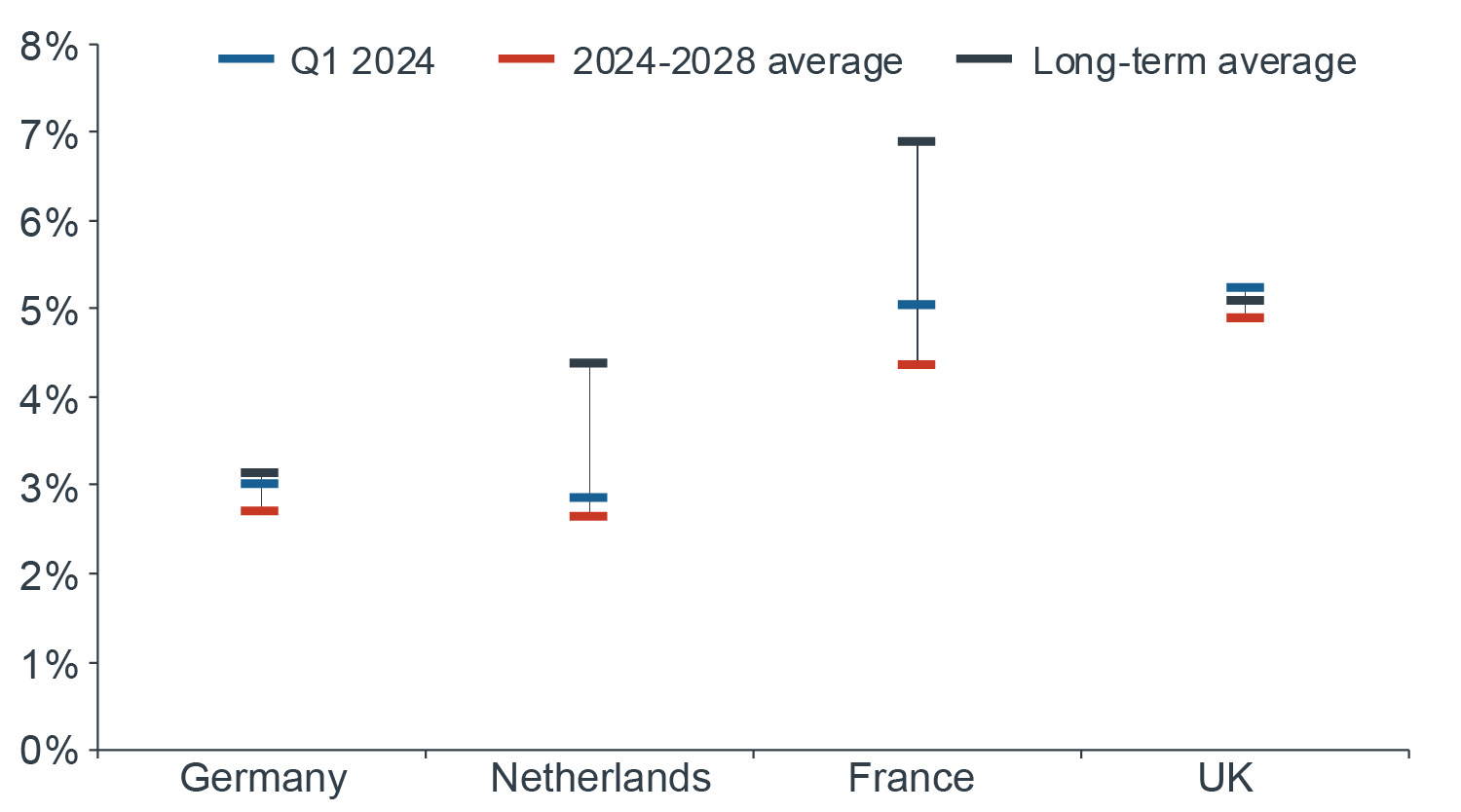

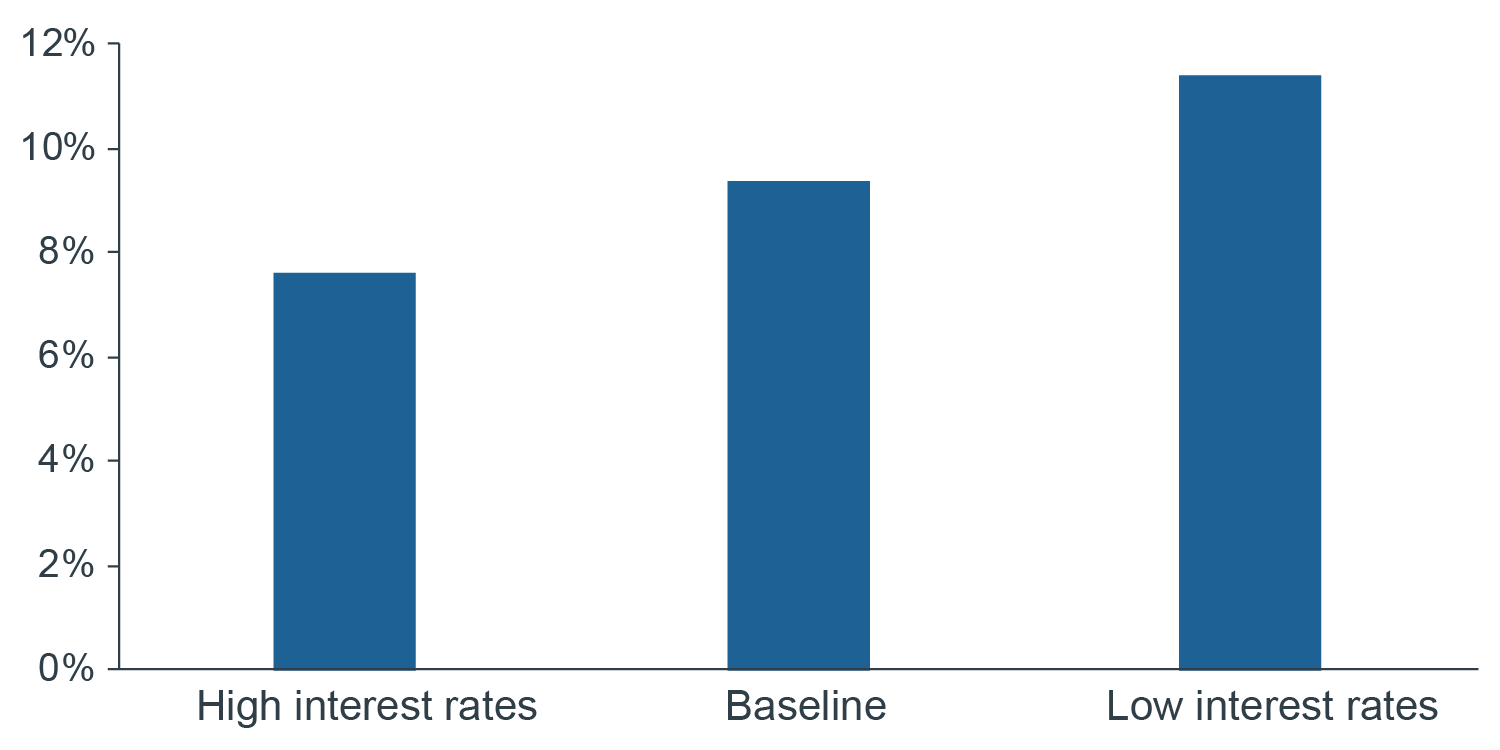

Logistics remains the most sought-after property sector in Europe10 and we anticipate that the return of core capital – which has been largely on the sidelines over last 18-24 months – has the potential to drive yield compression and bolster values later in 2024/2025. Lower than expected interest rate/ cost of debt could boost further what is already an attractive return profile for European logistics (Figure 5).

FIGURE 5: TOTAL UNLEVERED RETURN FORECASTS FOR

EUROPEAN LOGISTICS (PA, 2024-2028)

Source: Clarion Partners Investment Research, April 2024.

NUMEROUS OPPORTUNITIES AHEAD

We believe that the combination of resilient market fundamentals in European logistics and the recent value adjustment could position European logistics properties for a potentially attractive period in the coming years. To best capitalize on these opportunities, we recommend the following strategies:

Seize the opportunity presented by market dislocation: the recent repricing has opened a unique chance to acquire high quality assets at a significant discount compared to their peak market prices. These assets are frequently available at or near replacement costs, particularly in cases where sales are driven by distress.

Focus on asset and location quality: In the short term, we anticipate a wider range of performance at the asset level due to the economic slowdown and normalization of market fundamentals. This calls for a more selective approach to asset selection. Additionally, as we enter this new cycle, investors should pay even greater attention to the operational performance of their assets to drive returns, especially considering the uncertainty surrounding interest rates which are likely to settle well above the levels seen post-Global Financial Crisis (GFC).

In a broader sense, we believe that modern, well-specified assets are positioned to outperform. These assets require limited capital expenditure and are increasingly desired by occupiers for their sustainability credentials and operational efficiencies. With the growing obstacles to new logistics development and occupiers' continued preference for quality, the supply/demand imbalance of well-located Grade A spaces is likely to persist in most European logistics markets, driving ongoing rental growth. We forecast prime headline rental growth of 4-5% over the next five years in core European logistics markets.11

Unlock value by targeting under-rented assets: Given the significant rental growth experienced in the European logistics sector over recent years, investors can achieve strong net operating income (NOI) growth and enhance the value of their assets through asset management. With low vacancy rates prevailing across most markets and the growing probability of an economic soft-landing, there is potential to attain Core+ type returns for Core-level risk.

Selectively consider development: In the last 12-18 months, logistics development has encountered obstacles due to escalating construction and finance expenses, coupled with higher exit yield expectations. Although replacement costs stabilized in 2023, yields on costs may need further adjustment to offset development risk for investors in numerous cases. As construction costs begin to decrease and the market finds stability, we believe that development will progressively become more appealing from a risk-adjusted standpoint.

OUTLOOK

Despite tighter monetary conditions and increased geopolitical uncertainties, the European economy has shown resilience. With fading prospects of further rate hikes and reduced risks of recession, we anticipate that asset values will begin a recovery soon and debt capital costs will improve. These factors provide tailwinds for the logistics sector as it enters a new cycle.

Confidence in the logistics sector is bolstered by powerful and enduring structural themes. Despite some short-term challenges, we expect the sector to continue experiencing robust demand, ultimately delivering the most favorable risk-adjusted returns among the four major property types.12

For more information about our European investment capabilities and scope of coverage, visit www.clarionpartnerseurope.com