Despite widespread use in institutional portfolios, alternative investments are not typically found in US defined contribution plans. Tripp Braillard, Head of Defined Contribution Distribution at Clarion Partners, and Drew Carrington, Head of Institutional Defined Contribution at Franklin Templeton, explain why perhaps they should be.

For a variety of reasons, the US defined contribution (DC) industry can be reasonably described as risk averse. Decisionmakers, from plan sponsors to consultants, generally seek to avoid any decision that might be perceived as risky, whether it’s plan design, investment choices or manager selection. In addition, ERISA’s standard of prudence (often referred to as the “prudent expert” standard), frequently is interpreted as “doing what everyone else is doing.” This is, of course, in addition to all of the important responsibilities of a fiduciary, such as regular meetings, thorough documentation, investment policies, and hiring experts.1

So, when it comes to a topic like alternative investments in DC plans, the first reaction for many DC decisionmakers is reflexive avoidance. Even before the investment case is made, or specific asset classes are considered, the reaction is often, “That sounds risky, I’ll wait until others have blazed that trail. We don’t want to be first.”

Institutional investors such as defined benefit (DB) plans, endowments and foundations have long enjoyed the benefits of alternative assets, including real estate. In fact, the average institutional investor allocates 10.1% to private commercial real estate.2 By comparison, Large US DC plans are dramatically underweight to alternative investments with just a 0.26% allocation within their target-date and balanced funds as of 2020.3

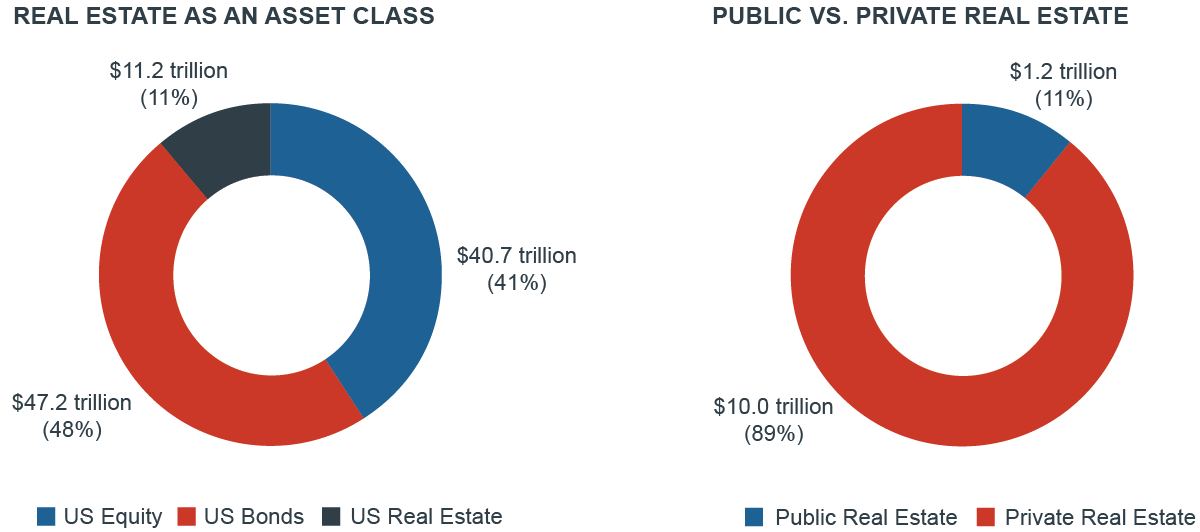

The underweight is true even compared to other nations’ daily valued DC systems, such as Australia’s Superannuation funds, which allocate over 11% to private assets, including real estate.4 Furthermore, real estate is the third-largest investable asset class and represents 11% of US investable assets. Of all investable US real estate, $10 trillion (89%) is private commercial real estate, while $1.3 trillion (11%) is listed real estate investment trusts (REITs).5

WHY COMMERCIAL REAL ESTATE IN A MULTI-ASSET PORTFOLIO?6

Sources: Securities Industry and Financial Markets Association, Urban Land Institute, NAREIT, NCREIF, Clarion Partners Investment Research, annual data and estimates as of fourth-quarter 2020. US debt includes corporate securities, ABS, Treasury debt, Federal agency debt including MBS, money market funds, and muni bonds. US real estate includes private and public equity investment. Past performance is not indicative of future results. Valuations and incomes may change more rapidly and significantly than under standard market conditions.

US DB plans have utilized private real estate for all of the reasons one might expect: private real estate can be a powerful diversifier, generally produces stable, income-based returns, and has inflation-hedging properties. And there’s no reason why DC plan participants shouldn’t enjoy these benefits, as well. Private real estate can be easily accessed through a professionally managed portfolio, such as a target-date fund (TDF), managed account or white-label, multi-manager portfolio (such as a real asset fund), providing participants with the same advantages that large institutional investors already experience.

Further, because a number of intrepid souls have blazed the trail, it means plans considering adding private real estate today will not be first or doing something new. The array of plan providers, such as custodians, recordkeepers, managed account providers and glide path managers, have all considered private real estate allocations, determined appropriate allocations and worked through operational issues that might arise. Most of the products available in the DC market today (there are over a dozen), have daily valuation, regular liquidity, and DC plan-friendly vehicle designs, such as using collective investment trusts to house the private real estate stakes. Today, assets in private real estate (not REITs) in 401(k) plans currently exceed $37 billion and are utilized in over 14,000 plans.7

In addition, the regulatory and litigation (and legislative) environment has turned more friendly to the use of alternative assets in DC plans (for example, see the Department of Labor’s information letter on the fiduciary implications of using alternatives in professionally managed structures from June of 2020, Intel’s victory in its lawsuit regarding the use of alternatives in its TDFs, and several legislative efforts to codify the appropriateness of using a wide array of asset categories in an ERISA plan, even a participant-directed plan such as a 401(k)).

Finally, it bears asking: is the worry about being “first” a primary factor for plan fiduciaries? Given that more than 14,000 plan sponsors have already incorporated private real estate in their plans, to the tune of tens of billions of dollars, perhaps we should consider using private real estate on its merits—especially in a market environment like today, with reduced expectations for returns on a traditional 60/40 portfolio and stubbornly high inflation.

Perhaps instead of worrying about “being first”—or even early—the greater worry should be about what participants may be missing by not having access to an asset class with the risk and return characteristics of private real estate.

DC plans represent almost $10 trillion of tax-advantaged assets set aside for multi-decade horizons, to meet retirement obligations far in the future—just like defined benefit plans. DC plans are governed by ERISA and overseen by fiduciaries—just like defined benefit plans. DC plans utilize professionally managed asset allocation solutions, with investment policies and expert advice—just like defined benefit plans.8

Since the obligation to save and invest for retirement has been largely transferred to individuals, isn’t it time more investors in DC plans have access to the same sophisticated investment toolbox used for decades in defined benefit plans? We certainly think so!