Executive Summary

An Attractive Entry Point for Investors: Logistics asset values have rebased and some markets are starting to show early signs of yield compression, while market fundamentals remain solid.

A Strategic, Selective Approach: Unlike the broad yield compression of previous cycles, we think future outperformance will be driven by

strategic market and asset selection. Our focus is on modern, ESG-compliant logistics facilities in supply-constrained markets.

-

Positioned for Long-Term Value Creation: The shift toward high-quality, sustainable assets is accelerating, with tenants prioritising efficiency

and productivity. We believe investors who align with these trends can secure premium rents, lower vacancy risks, and stronger long-term returns.

A NEW CYCLE BEGINS

2024 was a transitional year for European logistics, with capital markets showing early signs of recovery, while the occupational market remained relatively sluggish. With demand conditions stabilising, we believe 2025 is an inflection year offering a potentially compelling entry point into a new cycle. Asset values have rebased, and occupier activity appears poised for recovery in the favourable context of declining European interest rates and soft, albeit positive economic growth. Unlike the previous cycle, where yield compression benefited all markets, we expect that performance in the new cycle will be more nuanced and increasingly depend on careful market and asset selection. To fully capitalise on the emerging cycle, we think investors should focus on modern assets, which occupiers are increasingly favouring for their efficiency and sustainability benefits amid rapid technological advancements and evolving ESG standards.

CAPITAL MARKET CORRECTION LARGELY COMPLETED

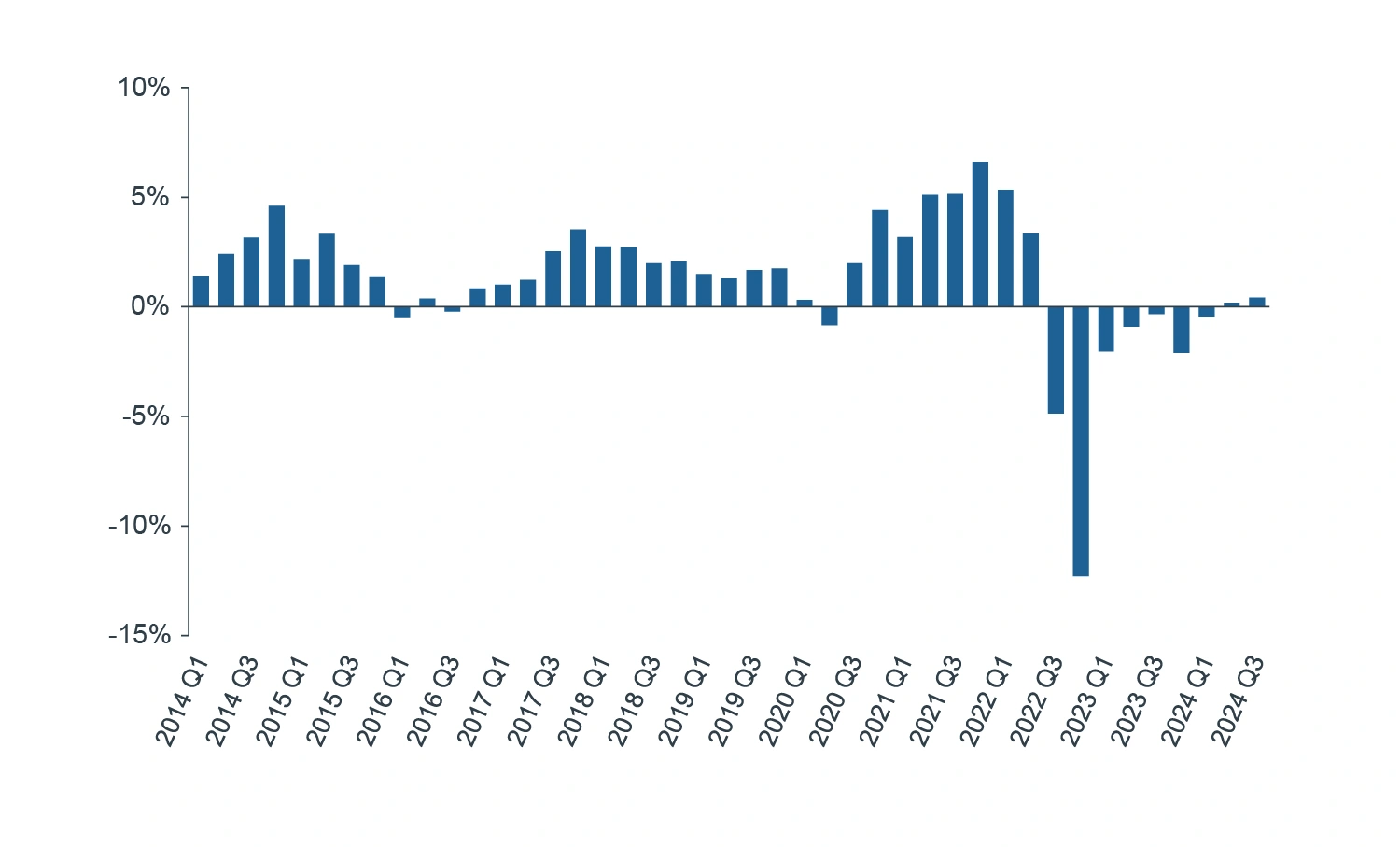

The correction in asset values that began in 2022 appears to have largely run its course, with valuations and real-time price indices having stabilised and starting to show signs of recovery. INREV Industrial/Logistics capital growth has been positive for two consecutive quarters ending 3Q 2024 (Figure 1). The stabilisation of inflation and subsequent ongoing monetary policy easing have injected a sense of optimism into capital markets. However, this sentiment has recently been tempered by renewed concerns about the economic outlook, as well as volatility in swap rates and debt costs, partly driven by persistent worries over inflationary policies within and beyond Europe (most notably the U.S.).

FIGURE 1: INREV EUROPEAN LOGISTICS CAPITAL GROWTH

Source: INREV, Clarion Partners Global Research, 3Q 2024.

Liquidity continued to improve in 2024, with total transaction volumes exceeding €40 billion – a 21% increase compared to 2023. The last quarter of 2024 was particularly strong, recording nearly €14 billion in transactions, the highest quarterly figure since 3Q 2022. The logistics sector remains a standout, accounting for an elevated share of total direct investment volumes (~20%) in Europe, underscoring its sustained appeal relative to other property types.1

SOLID FUNDAMENTALS

Despite economic (and hence demand for space) challenges, the fundamentals of the European logistics market remain healthy. In 2024, demand began to normalise from the pandemic-induced frenzy of 2021-2022 which brought forward occupier usage. High interest rates and economic uncertainty have weighed on corporate decision-making, contributing to a 12% drop in European logistics take-up in 2024 compared to 2023.2

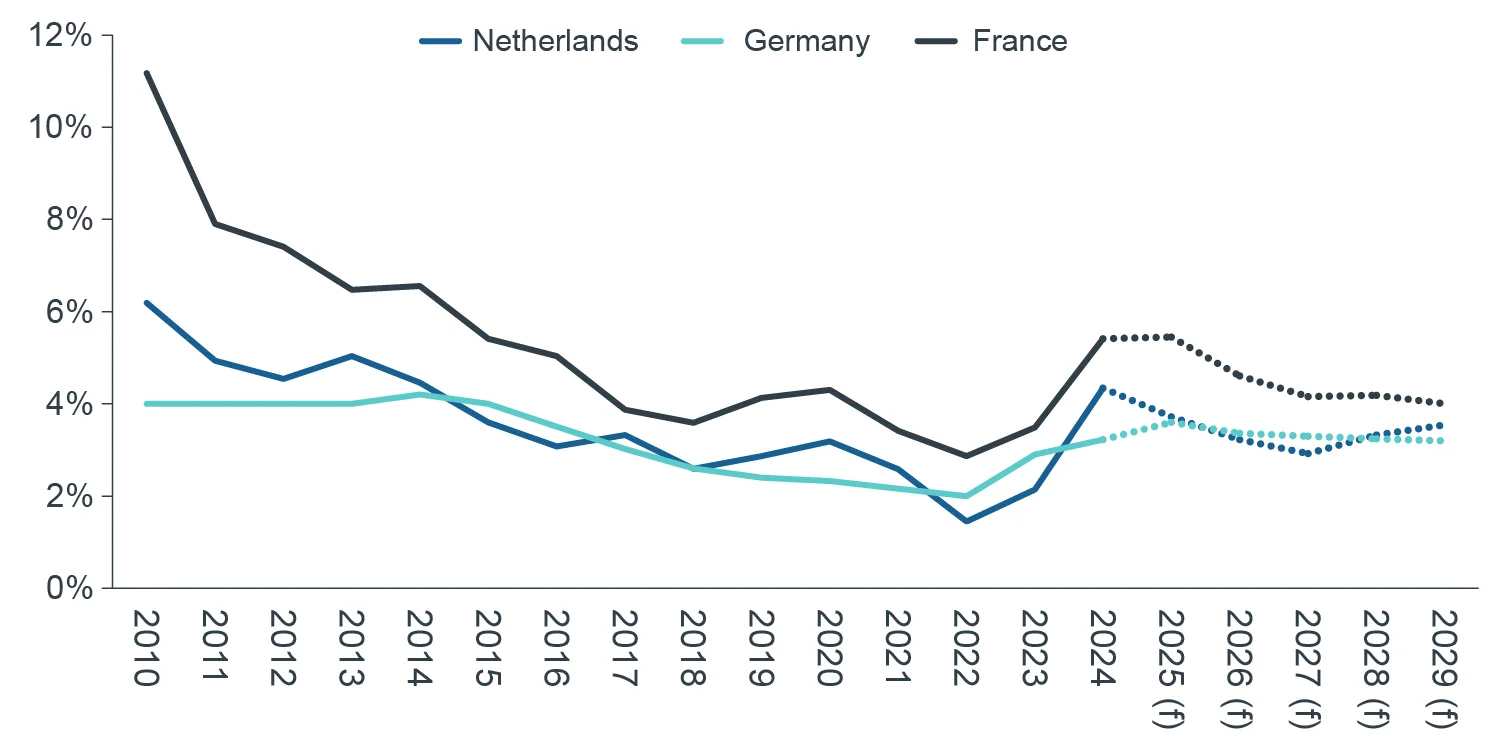

The demand slowdown has pushed European logistics vacancy to 4.8%, slightly above its long-term average of 4.5%. However, with logistics stock expanding at its slowest pace since 2013 (+0.9% QoQ in 4Q 2024) and only 4.3% of total stock currently under construction – well below the five-year average annual increase of 6.7% – vacancy is expected to peak soon and potentially decline (Figure 2) as demand recovers, which should, in turn, support rental growth. Rental growth expectations have moderated but remain historically strong. The latest logistics rental growth forecast produced by UK IPF Consensus Forecast – possibly the longest series of forecasts of its kind in Europe – came in at 3.6% for the UK over the next five years – still one of the highest readings on record. We forecast prime headline rental growth of 2.8% to 3.7% per annum for core Western European markets from 2025 to 2029.

FIGURE 2: VACANCY RATE OF FRANCE, GERMANY & THE NETHERLANDS

Source: Clarion Partners Global Research forecasts based on CBRE data, 3Q 2024.

Beyond rental growth, there is significant upside potential from marking under-rented leases to market (Figure 3). Together, these factors suggest that the sector’s NOI growth prospects are among the most compelling they have been since 2015, reinforcing our view that it remains attractively priced.

FIGURE 3: NOI GROWTH POTENTIAL

Source: CBRE, IPF, Clarion Partners Global Research, February 2025. Note: Mark-to-Market estimate based on Eurozone logistics rent growth; assumes all leases are 5 years and begin at market and are indexed to inflation. Rental growth expectations sourced from IPF UK consensus forecasts.

NAVIGATING THE NEW LOGISTICS CYCLE: SEARCHING FOR (RELATIVE) VALUE

In contrast to the previous cycle, where yield compression “lifted all boats”, we believe that superior performance in the new cycle will be increasingly dependent on meticulous market and asset selection, as well as effective asset management. Our strategy remains consistent for 2025: we continue to favor supply-constrained markets with high barriers to entry, primarily in core Western Europe and, more selectively, in logistics gateway locations in Southern Europe, Central and Eastern Europe (CEE), and the Nordics.

France and the Netherlands remain top of our deployment list, and we continue to see value in German logistics despite the country’s economic challenges, as many key markets continue to be characterised by low supply and demand fundamentals remain strong. On a pure initial yield basis, some European markets such as Spain or the Czech Republic still look tightly priced by recent norms but may become more attractive as the repricing cycle concludes (Figure 4). In Spain, the country’s positive economic performance contrasts with relatively soft occupier market fundamentals and high vacancy rates, though these appear to have peaked lately. Poland has adjusted faster than the Czech Republic from a pricing perspective but concerns around lower barriers to entry for development remain and need to be priced in. Italy has one of the lowest vacancy rates in Europe and attractive fundamentals with ample runway for e-commerce growth albeit we are seeing a delayed increase in supply.

FIGURE 4: NET YIELD SPREAD VERSUS GERMANY

Source:

Clarion Partners Global Research calculations based on CBRE data, 4Q 2024.

With construction costs stabilizing and values improving, we believe development – in the right locations – has become more attractive on a risk-adjusted basis. According to latest research from Green Street, the spread between development and investment yield for European Big Box logistics has widened to 160bps as of January 2025, from 120bps as of December 2022.

MODERN PORTFOLIOS STAND TO BENEFIT AS OCCUPIERS FLOCK TO QUALITY

In many markets, the supply of modern, ESG-compliant logistics space is more constrained than overall vacancy rates suggest, as occupiers continue their flight to quality. Over the past 12 months, nearly twothirds of take-up has been for newly built space – a trend we expect to accelerate amid the rapidly evolving technology and ESG landscape.

Occupiers are increasingly choosing modern buildings for their cost-efficient features – such as improved insulation, energy-efficient heating systems, motion-activated LED lighting, smart building management systems, and solar panels – as well as their flexibility and strong sustainability credentials. Unsurprisingly, these properties tend to achieve higher occupancy rates and command premium rents.3 Data from Savills in the Netherlands show that units built between 2010 and 2020 have a vacancy rate of just 1%, compared to an average of 4.4% across all buildings.

ESG HERE TO STAY

Sustainability considerations will increasingly guide asset selection in the nascent cycle as pressures to rein in global greenhouse emissions intensify at all levels. 2024 was the first calendar year to pass the symbolic threshold of 1.5 degree temperature increase relative to pre-industrial levels enshrined in the Paris Agreement of 2015.4 Despite some recent backlash, institutional capital allocators continue to pay close attention to the ESG agenda as they seek to future-proof portfolios and achieve sustainable longer-term returns. Equally, EU-regulation on building sustainability continues to tighten, with the recently approved Revised Energy Performance of Building Directive setting ambitious carbon and energy reduction targets for the built environment. Against this backdrop, assets and portfolios with strong ESG credentials are well-positioned to outperform benchmarks in the new cycle in our view.

Moreover, growing data and literature on the so-called “green premium” and “brown discount” increasingly point to the positive impact of ESG features on a property’s marketability and value. Studies consistently suggest that assets with recognised “green” certifications – such as LEED or BREEAM – tend to command higher rents and valuations. For instance, a recent study by C&W indicates that logistics assets with high ESG ratings achieve an average pricing premium of 19% compared to those with low or no ratings.5 As the climate transition progresses, effectively identifying and pricing ESG improvements has become increasingly critical in underwriting decisions.

2025: A POTENTIALLY GOOD VINTAGE IN THE MAKING

The outlook for European logistics in 2025 is one of cautious optimism. Assuming recent volatility in financial markets is temporary, we expect liquidity to improve and pricing to continue to firm up. Investor appetite for European logistics remains strong – according to CBRE’s 2025 European Investor Intentions Survey, the sector was the second most favored asset class, after residential. In some markets, we are already seeing early signs of yield compression (Figure 5) as capital, including core buyers, returns to the market. We are also witnessing the return of larger pan-European portfolios, which were the first to be withdrawn during the repricing period as liquidity dried up.

FIGURE 5: YIELD CHANGE FOR 25 LOGISTICS MARKETS

Source:

CBRE, Clarion Partners Global Research, December 2024.

Pricing is expected to remain supported by healthy fundamentals. The European logistics sector has an estimated average rental upside of 10-15%, which can be realised by marking in-place rents to market. Added to this is the potential for inflation-beating rental growth. With new supply retreating and occupier demand set to recover – assuming the European economy stays on course – we believe 2025 could be a promising vintage for European logistics property.

We anticipate that core logistics properties in Western Europe could deliver unlevered IRRs of 7-8% per annum over a five-year hold period assuming no yield compression, rising to 8.5-9.0% per annum assuming modest yield compression of 25bps, offering what we believe is a

relatively generous spread over the risk-free rate. Despite recent challenges, the case for European logistics remains compelling.

CONCLUSIONS

European logistics remains supported by strong fundamentals and a resilient rental growth profile, providing a solid foundation for long-term performance. With asset values stabilising, liquidity improving, and occupier demand set to recover, we see 2025 as a compelling entry point to capitalise on the sector’s enduring strengths.

To fully take advantage on this cycle, investors should focus on the future – modern, newly built facilities that provide tenants with state-of-the-art distribution capabilities. As supply chains become increasingly technology-driven, we believe that a forward-looking logistics portfolio is essential for capturing the recovery and securing superior long-term returns. The logistics sector is likely at a turning point, and investors who align with evolving tenant demands today should be best positioned for success tomorrow.