INTRODUCTION

On April 7, 2022, a group of bipartisan legislators introduced The Opportunity Zones Transparency, Extension, and Improvement Act (the Act). If enacted later this year, this legislation would be the first substantial update to the Opportunity Zone (OZ) statute since it was enacted in 2017. The bill extends the deferral period for qualified capital gains through 2028, requires the sunset of certain OZ tract designations, imposes new reporting requirements to promote transparency, and creates a new entity, the “State and Community Dynamism Fund” to provide assistance to state and local governments. Broad-based support suggests that the proposal may be a likely option for inclusion in tax legislative vehicles, which is likely to be reviewed by Congress later this year when it moves forward in considering future tax packages generally. Existing OZ investments are likely to be grandfathered in the event of a re-designation of OZ districts.

Source: Holland & Knight. Congress Looks to Update Opportunity Zone Program with Bipartisan, April 2022.

OPPORTUNITY ZONE INVESTING: TAX ADVANTAGES WITH A BIG SOCIAL IMPACT

The Opportunity Zone (“OZ”) program is a bipartisan public-private partnership community development initiative established by the U.S. Tax Cuts and Jobs Act (TCJA) in 2017 that provides tax benefits for investors and encourages long-term private sector investments in America’s underserved communities. The program presents both a catalyst for economic development and sizable commercial real estate (CRE) investment opportunities. Furthermore, some investors are looking at OZ fund investments as an alternative to the 1031 exchange program, now facing an uncertain future.

In the first few years of the OZ program, approximately $75 billion had been raised primarily in private fund investment vehicles and capital raising is likely to accelerate over the next decade.1 The program is largely supported as an ongoing policy within the Biden Administration, which may be further incentivized by additional Internal Tax Revenue (IRS) tax law revisions, as well as broad and ambitious policy goals within the Environmental, Social, & Governance (ESG) framework.2

NEW TAX POLICY MAY LEAD INVESTOR MIGRATION TO OZs FROM 1031 EXCHANGES

Currently, two proposals in Congress, if enacted into law, would likely provide incentives for further investment into OZ CRE funds.

1) The removal of the 1031 exchange provision, and;

2) Higher long-term capital gains taxes

If these proposals become law, it is likely that capital flows into OZ funds will increase. However, we also expect steady ongoing demand if the current legislation remains unchanged. Today OZ investments serve as a viable alternative to a 1031 exchange – a long-time tax benefit employed by CRE investors since the early 1990s. While both programs allow investors to reinvest gains into property to defer or eliminate taxable capital gains, there are key differences between the two programs, as highlighted below (Figure 1).

BENEFITS OF OZs VS 1031 EXCHANGES

OZ funds offer distinct benefits relative to 1031 exchanges. Most importantly, OZ investments have the advantage of significantly reducing the tax liability on the original capital gain and completely eliminating capital gains taxes on the appreciation of the OZ investment over time, whereas a 1031 exchange merely delays these taxes until property disposition. Furthermore, any taxable gain from the sale of any asset class can be re-invested in an OZ fund, whereas both the original equity and capital gains proceeds from a real estate disposition can be applied in a 1031 exchange. More advantages are highlighted in greater detail below.

(I) Gain Liquidity - Free Up Original Principal. In a 1031 exchange, investors are required to re-deploy their original principal and gains, and even roll forward their debt; on the other hand, OZ investors can re-invest capital gains alone from a prior asset sale and keep their original basis, creating instant liquidity.3

(II) Extend Transactional Window - 180 vs 45 Days. OZ investors are given 180 days to identify an OZ fund investment that suits them, while 1031 exchanges only give investors 45 days to identify replacement property to complete the “like kind” exchange. If something happens with one of the properties identified and the investor is past the 45-day deadline, the options are to go forward with the deal or risk losing 1031 benefits.4

(III) Failed 1031s May Still Qualify for OZs. If an investor’s 45-day clock expired and one is unable or unwilling to roll their 1031 dollars forward, they can still take advantage of OZ benefits as long as they are within 180 days of realizing their gains.5

(IV) Reduce Risk - Diversify Investments. While OZ funds are generally diversified multi-asset portfolios, 1031 investments must be made in like-kind properties, which means redirecting funds from one property to another larger property. In times of uncertainty, single asset investments may have a higher degree of risk. Thus, 1031 investors are increasingly opting into diverse funds to avoid potentially riskier investments.6

FIGURE 1: OZ VS. 1031 EXCHANGE PROGRAM GUIDELINES & TAX BENEFITS

OZ INVESTMENT SALES RISE: LED BY MULTIFAMILY & INDUSTRIAL

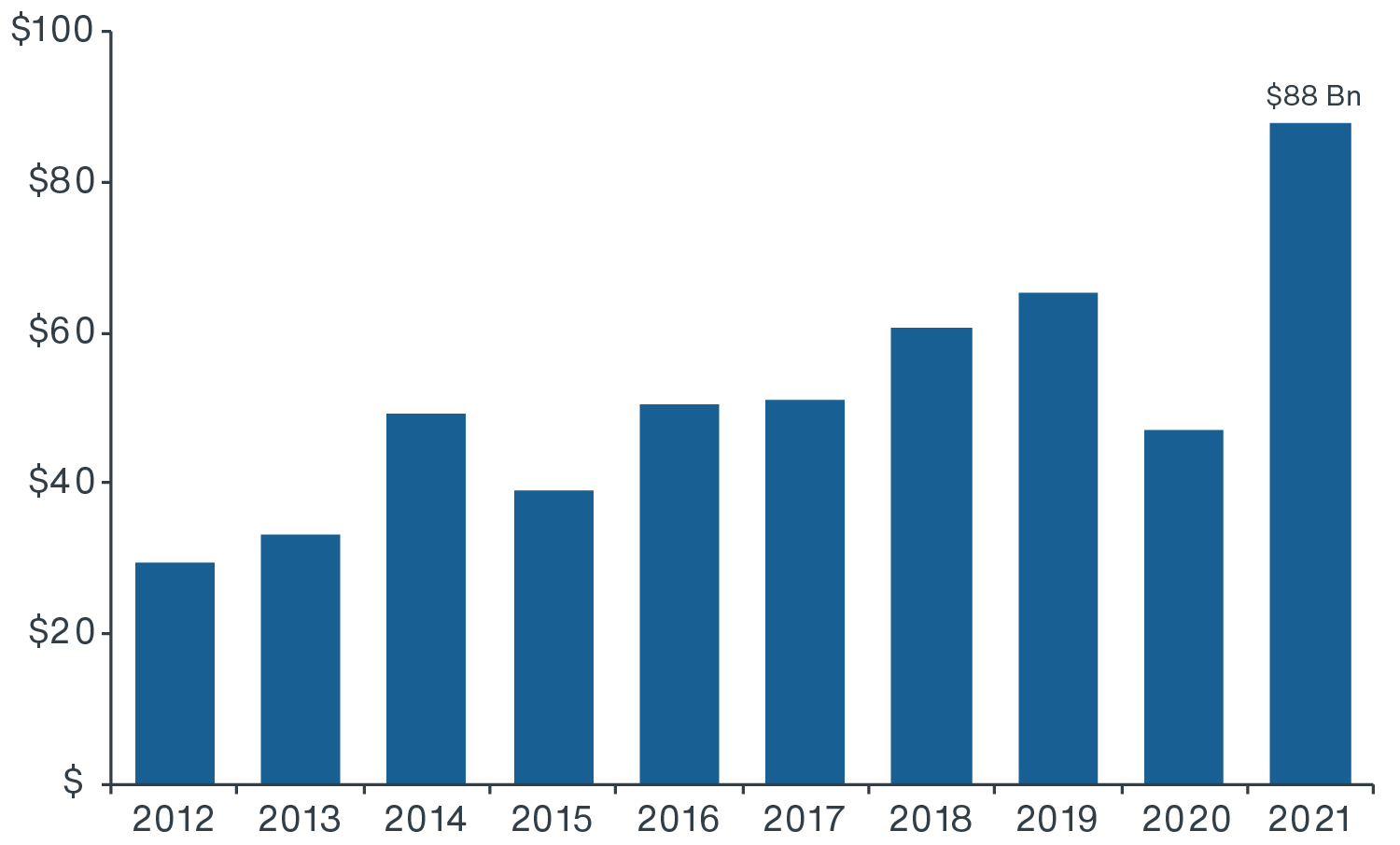

The speed of capital formation and rise of transaction volume in OZ investments have been significant. This can be largely attributed to strong bi-partisan support for the program. Since 2017, U.S. investment sales in OZs has totaled approximately $312 billion. Annual OZ transaction volume reached a peak of $88 billion in 2021, which represented over 10% of overall U.S. CRE investment activity (Figure 2).8 In recent years, multifamily investments have made up by far the largest share of transactional volume, followed by industrial; the two sectors combined have made up well over 50% of total OZ acquisition volume.9

FIGURE 2: U.S. PROPERTY TRANSACTION VOLUME IN

OPPORTUNITY ZONES 2011- 2021

($ BILLIONS)

Source: Real Capital Analytics, Clarion Partners Investment Research, April 2022. Notes: 1) Data represents volume located within the designated OZs. 2) FY 2021 forecast based on the annualized rate of year-to-date transaction volume in OZs through August 2021.

Looking ahead, higher investor interest in multifamily and industrial assets in OZ funds may persist due to a confluence of structural, demographic, and socioeconomic drivers. Institutional-quality rental housing remains in short-supply across many top U.S. employment hubs amidst an all-time low in for-sale housing affordability. Similarly, industrial warehouse and distribution property continues to be in high demand, as e-commerce rises rapidly as a share of retail sales (now approximately 20%). Both property types have continued to report near record levels of leasing activity each quarter over recent years. Given such tailwinds, these sectors’ vacancy rates have remained at all-time lows, while rents have also been at historic highs nationwide.10 At this time in the U.S. economic recovery, we do not anticipate any significant structural or cyclical risks ahead for these property types, however, any unexpected economic downturn is always impactful on overall CRE demand.

OZ FUND MARKET OUTLOOK

The emerging OZ investment opportunity is quickly becoming large. With an estimated $6 trillion of unrealized capital gains on individual and corporate balance sheets in the U.S., OZs have the potential to become an important and effective vehicle for mitigating capital gains taxes.11 Furthermore, OZs are benefiting from greater political momentum, specifically the tremendous growth of ESG investing.

ESG is now an approximately $30 trillion global asset class, and OZs are included in this rapidly growing category.12 The ‘S’ in ESG, which refers to social impact, is now gaining traction as well in CRE institutional investment management. As a more recent tax policy that continues to generate investor interest, OZs are becoming one of the key catalysts for community transformation in the U.S. The potential role of OZs as a program to drive broader policy goals within the ESG agenda is extraordinary, especially since it is one of President Biden’s primary initiatives.