Updated Energy Codes for Commercial Buildings

The U.S. Department of Energy (DOE) works with the American Society of Heating, Refrigerating & Air-Conditioning Engineers (ASHRAE) organization to produce energy codes, which are frequently updated. These guidelines are generally implemented at the state level.

As of Q2 2023, 39 states had adopted a version of the ASHRAE code that is equivalent to or higher than the current U.S. Department of Housing & Urban Development (HUD)-USDA standard of the 2009 International Energy Conservation Code (IECC).3 Incentives have been offered to those states that increase their baseline code to meet at least the equivalent of ASHRAE 90.1-2019, which only a few states have adopted so far.4

Green Banks

As part of the U.S. Environmental Protection Agency (EPA) effort to deliver on national GHG reduction pledges, local green banks were created to leverage public and private capital to fund and accelerate clean energy and infrastructure projects. As states, cities, and businesses plan to meet their decarbonization goals, grid resilience, and energy affordability policy objectives, green banks offer innovative and accretive financing solutions.

Climate Disclosure Mandates

The Financial Stability Board (FSB) created the Task Force on Climate-Related Disclosures (TCFD), a finance initiative comprised of public and private international companies, to develop consistent climate-related financial risk disclosures to support investors, lenders, and insurance underwriters.5 Following the creation of the TCFD, the U.S. Securities & Exchange Commission (SEC) enacted a law requiring public companies to include climate-related disclosures in 2022. A similar bill requiring large private companies to report these disclosures is pending approval by Congress.

New Power Regulations Planned

In May 2023, the U.S. EPA proposed new rules regarding power plant standards as part of the Biden administration’s broader plan to reduce GHGs with the primary goal of improving electric grid energy efficiency. If passed, these potential changes to U.S. energy generation and distribution are likely to have widespread and material impacts on CRE.6

All of these federal and metro-level carbon reduction policies and goals are relevant to CRE’s GHG mitigation efforts and will require management on the asset level. So far, there are only 700 net zero buildings out of 5.9 million non-residential buildings in the U.S.7

BUILDING-LEVEL

Tracking building-level decarbonization is essential to meeting GHG reduction goals set by government policy to achieve net-zero targets. The National Building Performance Standard Coalition works to establish building performance standards (BPSs) and disclosures and to expand adoption by pulling together executive leadership from cities and states. The coalition, along with technical and policy support from the DOE, aims to share best practices and develop BPSs locally.

Currently, 42 jurisdictions have committed to passing a BPS by Spring 2024.8 Greater organization on a building level to manage energy efficiency is likely to accelerate the retrofit of existing building stock in order to comply with the latest commercial building energy codes. Furthermore, in certain regions, some building owners are and will be subject to penalties if they do not comply with the increasingly rigid BPSs.

CLEAN ENERGY TAX INCENTIVES: IMPLICATIONS OF IRA FOR U.S. CRE

The IRA, signed into law in August 2022, represents the largest federal investment yet that aims to reduce the nation’s carbon footprint by approximately 40% by 2030. Over the next decade, the IRA will advance roughly $370 billion of clean energy investment in the U.S. and includes new tax credit incentives that were previously unavailable to the CRE industry and real estate investment trust (REIT’s). The legislation also directs the DOE to allocate sizable funds to state and local governments to develop and adopt building codes that meet or exceed the zero-energy code IECC-2021, setting commercial buildings on a path to net zero.9

It also better enables CRE investors to leverage government incentives to cost-effectively decarbonize assets. These new tax breaks for energy-efficiency improvements in buildings have the potential to make new development and retrofit projects more financially viable. A number of the IRA’s proposed revisions to the federal tax code, administered by the U.S. Department of Internal Revenue Service (IRS), will be a significant benefit to the U.S. CRE industry, as it continues to reduce its carbon footprint. These incentives include:

- A deduction to help make commercial and multifamily buildings more energy efficient (Section 179D);

- A credit to encourage investments in renewable energy generation and other “clean energy” technologies sited at buildings and other facilities (Section 48);

- A credit to incentivize the installation of EV charging stations (Section 30C); and,

- A credit to incentivize energy-efficient new residential construction, including multifamily (Section 45L).10

INVESTOR CONSIDERATIONS

Opportunities

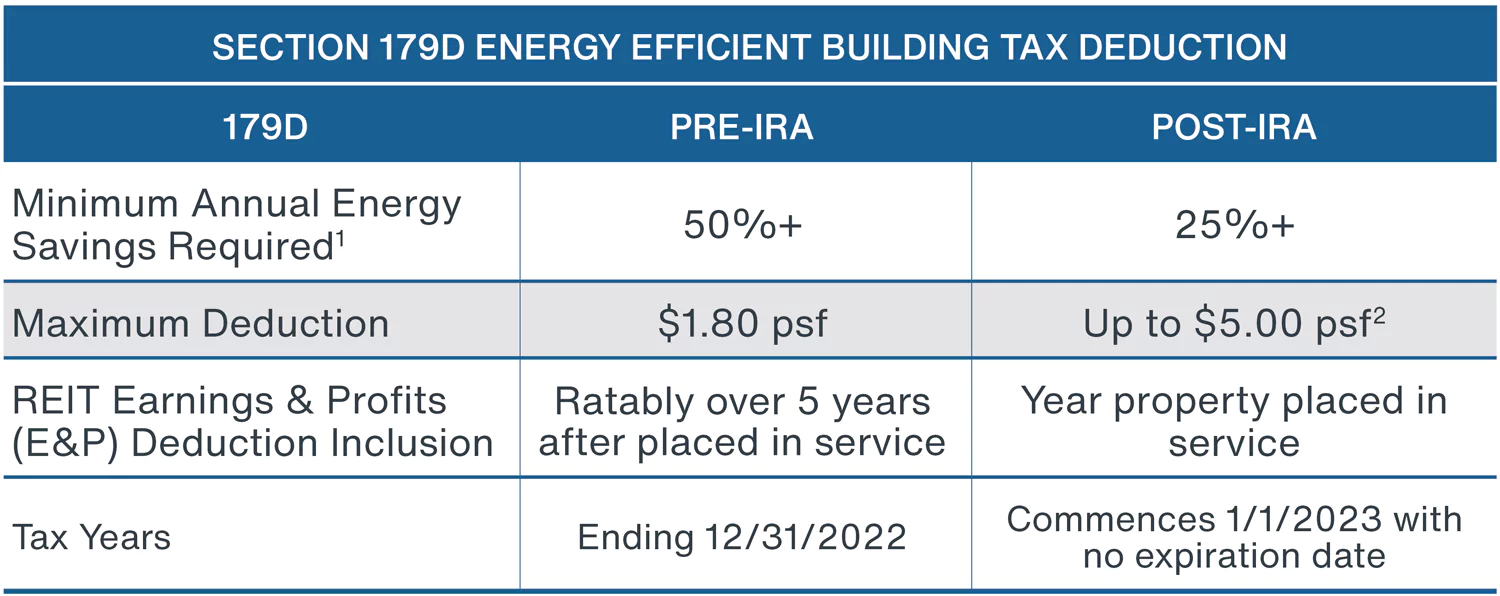

Prior to the IRA’s passage, the Section 179D tax incentive offered to CRE owners to reduce energy consumption was not sufficient to incorporate costly energy efficiency improvements into new building designs. The new IRS code changes expand the deduction from $1.80 psf to a sliding scale ranging from $2.50 to $5.00 psf through 2035 depending on the energy efficiencies achieved over the baseline of current ASHRAE standards (Figure 2). The Section 179D maximum deduction more than doubled, a large increase from the pre-IRA tax credits.11

The IRA’s additional deductions are especially significant for owners of more dated commercial buildings. Currently, over 50% of buildings in the U.S. were built prior to 2000.12 Without these extra tax credits, owners of many existing older buildings were not adequately incentivized to meet the required energy use deductions.

In addition, the IRA includes a provision that allows a property owner to reduce taxable earnings and profits by the amount of the Section 179D deduction in the year the energy improvements are made. This would result in a more immediate financial benefit. Other provisions include incentives for affordable housing, public facilities, domestically sourced construction materials, and projects that meet competitive labor wage standards.13

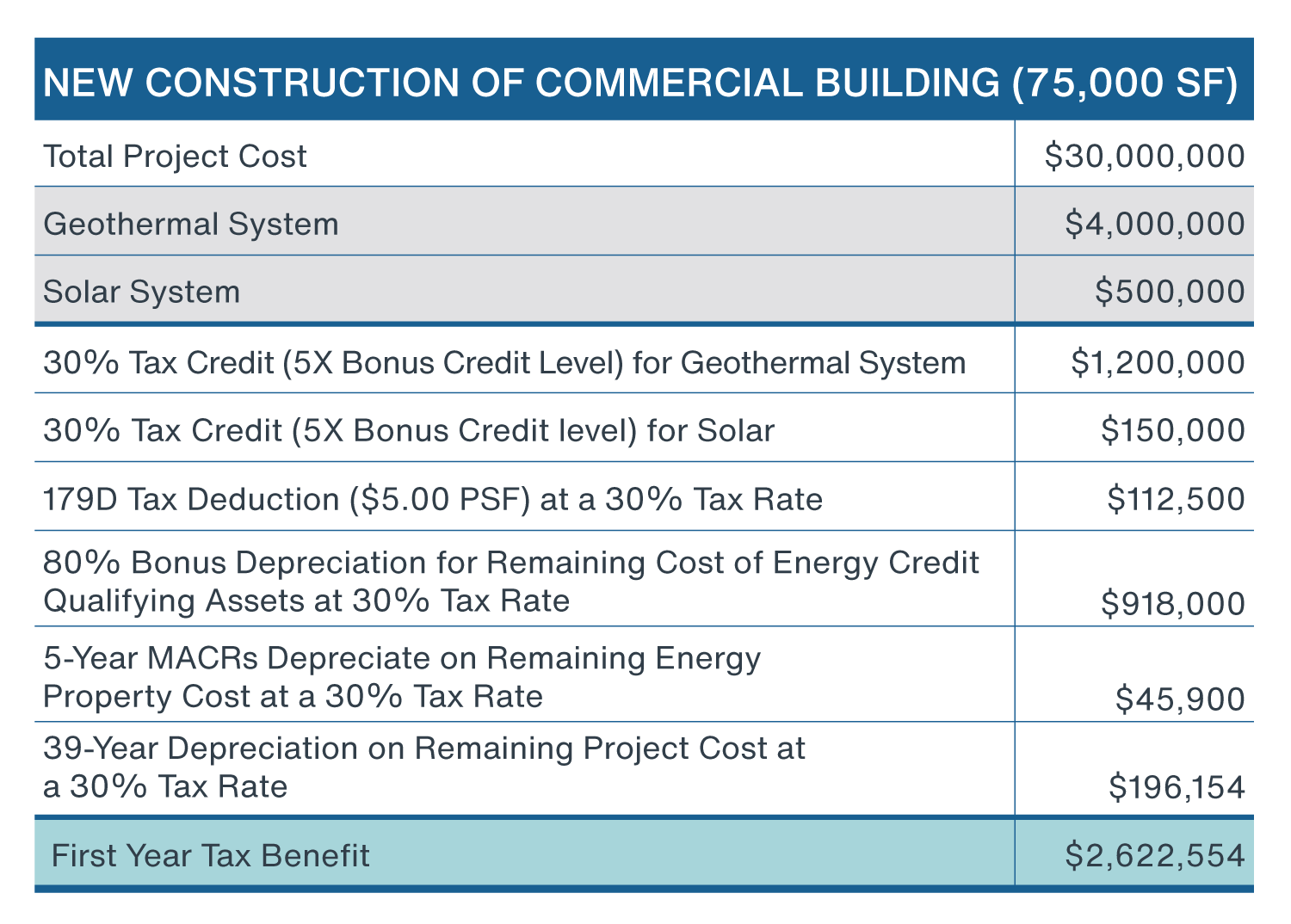

Figure 3 is a hypothetical example of potential cost savings at a newly constructed 75,000 square foot building with a total cost of $30 million. Assuming a $4 million geothermal system and a $500,000 solar system are included, the newly instituted Section 179D deduction and investment credit, along with other depreciation benefits, would result in a first-year tax benefit of over 50% of the energy systems’ costs, according to an analysis from FacilitiesNet (Figure 3).14 While this illustration is based on a new development, actual costs and tax benefits will vary significantly depending on the scope and type of project, as well as the ownership structure.

FIGURE 2: IMPACTS OF 2022 INFLATION REDUCTION ACT (IRA) ON U.S. REAL ESTATE SECTOR

Source: Chicago Business Journal, Clarion Partners Investment Research. May 2023. Notes: 1) Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, hot water systems, and envelope as compared to reference building that meets the minimum requirements of ASHRAE Standard 90.1-2007. 2) Deductions depend on meeting prevailing wage requirements.15

FIGURE 3: SECTION 179D AND INVESTMENT TAX CREDIT – A HYPOTHETICAL NEW CONSTRUCTION EXAMPLE

Source: FacilitiesNet. How the Inflation Reduction Act is Accelerating Energy Projects, 2023. Clarion Partners Investment Research, May 2023. Note: This hypothetical example is for illustration only; actual project costs and tax benefits may be different.

With these new energy tax incentives, property owners are now able to procure more immediate financial benefits. Additionally, more building types and beneficiaries are now offered these incentives starting in 2023.16

Lastly, the law is designed to support a permanent shift toward clean energy in current and future construction projects, which will reduce total energy consumption and operational expenses over the long run, which can also make or break the bottom line.17

Potential Risks

- Tax Incentive Shortfalls. While the IRA tax savings are more significant, the credits cost may still not be adequate to offset the energy reduction investment required to qualify for the tax incentives altogether and fail to deliver an adequate return on investment.

-

Pending Official Implementation. Many of the specifications within the bill will require further guidance from the U.S. Department of the Treasury and IRS before they are able to be implemented.18

-

Betting on Carbon Capture. Many of the proposed environmental regulations impacting CRE are connected to infrastructure updates and new carbon capture technology. The full adoption of these clean energy technologies will require significant funding well beyond the property level. The lack of real-world carbon capture data makes this a notable “bet” on tracking future emission reductions.19

SUMMARY

The U.S. regulatory environment has increasingly prioritized investing in a net zero economy. The Biden Administration, in collaboration with the SEC, IRS, and DOE, has passed groundbreaking legislation to reduce GHG emissions and encourage renewable energy. Amidst mounting policies, the CRE industry has made rapid progress mitigating and tracking its carbon footprint at the building level.

In 2022, institutional CRE investment managers’ participation in the Global Real Estate Sustainability Benchmark (GRESB) reached a record level and now includes nearly 100% coverage of the U.S. open-end real estate fund universe.20 Clarion Partners believes that the additional tax incentives provided by the IRA will accelerate sustainable new development and retrofit CRE projects. Many redevelopments that previously may not have been cost effective or profitable may now be more financially viable. Furthermore, decarbonizing buildings is a smart business practice, which can offer significant cost savings and enhance property values.